How to Become a Homeowner on a First-Time Buyer’s Budget

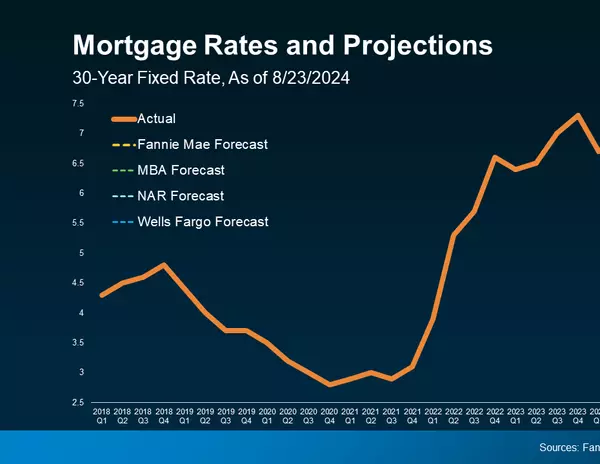

It's not easy being a first-time homebuyer right now. At the end of last year, housing affordability hit an all-time low.1 Additionally, mortgage rates have risen significantly since 2021, while inventory remains tight for many property categories, but especially for starter homes. Even lower-priced condos are harder to snag these days, as investors and downsizers muscle out first-timers by offering stronger, often cash-heavy bids.2 In fact, according to the National Association of Realtors, only 26% of last year's homebuyers were first-timers—the lowest share on record and down from 34% a year prior. This underscores just how steep a hill new buyers are facing.3 As a result, many first-time homebuyers are finding that they need to get creative or risk renting for longer than they planned. If you, too, are struggling to afford homeownership, here are some workarounds to consider as you plot your first home purchase. Try House Hacking “House hacking” is a real estate investment strategy in which participants use their homes to generate income in order to offset their expenditures. For example, renting out a basement apartment or accessory dwelling unit (ADU)—such as a detached garage that's been outfitted with a bathroom and small kitchen—counts as house hacking. So does splitting housing costs with a roommate or converting a part of your home into an Airbnb. House hacking isn’t new. But, it’s grown in popularity as a new crop of digital platforms has entered the market and made it easier than ever for homeowners to generate income from their property. In some cases, house hacking may make it possible for you to qualify for and afford your first home. A lender, for example, may approve you for a larger mortgage if you purchase a home with immediate income potential, such as a legal duplex or a property with a secondary suite that has a kitchen and full bathroom.4 In addition, house hacking could help you pay your mortgage once you move in. Here are just a few of the ways you could use your home to earn some extra cash: Offer paid parking in your driveway on a site like Spacer or SpotHero. Rent out your swimming pool for a few hours on Swimply. Make your home available for photoshoots or events on Giggster or Peerspace. Turn your backyard into a pay-by-the-hour dog park on Sniffspot. List your garage space on an app like Neighbor Storage. But before you make plans to house hack, make sure you fully understand an area's laws and HOA rules. We can help you find a home with income potential in a neighborhood with less restrictive zoning and regulations. Team Up With Friends or Family If you aren't wild about the idea of welcoming strangers to your home, you may want to consider co-purchasing with a friend or family member instead. This unconventional housing arrangement is also growing more popular as friends and family members cope with higher living costs by pooling resources. According to the National Association of Realtors' 2022 Profile of Home Buyers and Sellers, the share of first-time homebuyers living with people other than children or a romantic partner is currently at an all-time high.3 Meanwhile, research from Pew found that multigenerational living has accelerated especially quickly, with a quarter of U.S. adults aged 25 to 34 now living in a multigenerational home.5 Arrangements can be customized to fit your circumstances. For example, you could purchase a home and then rent a portion of it to a loved one. Or you might consider co-buying a home with friends or family members so that you can step onto the property ladder and start building equity together. Co-ownership could work out especially well for you long-term if it helps you to buy a home that's bigger, has more investment potential, or is located in a high-demand area and so appreciates at a faster rate. Plus, you'll get to see your loved ones more often and enjoy the coziness of shared living with people you like having around. On the other hand, sharing a big financial responsibility, like a mortgage, with friends or family could get messy—especially if you don't create a clear-cut co-ownership agreement beforehand that outlines your mutual expectations. So plan carefully before you proceed. In addition, you may need to rethink the type of home you pursue. For example, a smaller home might be cheaper, but do you really want that much togetherness all the time? We can help you set priorities and search for a suitable property. Tap Your Network for Help With Funding Another established method for affording a first home is to lean on family or friends for financial help. Getting assistance with the down payment or other borrowing costs can go a long way toward making your homeownership dreams come true. As long as you don't mind asking for help, a free-and-clear gift that's intended for your down payment is an ideal arrangement, since it will allow you to borrow less overall. Or, if that’s too big an ask, your loved ones could pitch in toward closing or moving costs. Alternatively, your loved ones could help by co-signing your loan. For example, if their credit score is a lot higher than yours, it could enable you to secure a lower interest rate so that your monthly payment is more affordable. According to a recent YouGov poll, more than a third of homeowners (and a whopping 79% of those under 30) received financial help from their parents when buying their first home.6 So you wouldn't be the only one leaning on family to help afford a home at today's prices. Just be sure your parents or other generous loved ones are aware they're giving a gift, not a loan, and are willing to put that in writing. A lender will want proof that this money isn't adding to your debt burden and may require documentation from your benefactors. Another way to tap your network for help is to crowdfund part of your down payment or ask for monetary gifts instead of tangible ones. For example, if you're getting married soon, you could skip the wedding gift registry and ask guests to contribute funds to your hoped-for home purchase instead. Look for Special Programs and Assistance You could also cut some of your upfront mortgage costs by applying for special grants and funding opportunities. For example, consider using a grant to help you fund your down payment. There are a number of public and private grants and down payment assistance programs that are expressly intended to help first-time buyers. Just like a gift, you don't have to pay a grant back. But, depending on your personal situation, you may find some grants difficult to qualify for—especially if you make a relatively high income. Many grants are reserved for lower-income buyers only.7 Check out grant programs, such as the HomePath Ready Buyer Program, National Homebuyers Fund, the Good Neighbor Next Door Program, and specialized grants from banks. Also look to state and local sources for potential grants and down payment assistance programs, including forgivable and deferred payment loans, Individual Development Accounts, and DPA Second Mortgages.7 Similarly, if you have enough income to support a house payment but can't spare much cash for your down payment, you may qualify for a government-sponsored loan, such as an FHA loan that allows you to put down as little as 3.5% to 10%.8 We can connect you with a lender or mortgage broker who can educate you about your options and help shepherd you through the process. Some financial assistance programs require you to work with specific lenders, while others require you to apply directly and fill out a separate application. In addition, you may look to even less conventional options, such as seller financing. But be aware these kinds of arrangements are rare and hard to find. Depending on the market, you will likely get more help from a seller if you ask them to pay closing costs or contribute to your mortgage rate buydown. In many cases, we can help you negotiate seller concessions that make your home purchase more affordable. Expand Your Home Search If you’re having trouble finding a home within your budget, consider broadening your search criteria. You may be surprised by the kinds of deals that are available when you're willing to compromise. For example, if you're struggling to find an affordable home in your target neighborhood, expand your search area and consider homes that are further out of town or that are located in up-and-coming areas with lower starting prices. We would be happy to introduce you to some great but lesser-known neighborhoods that we consider hidden gems. You could also save money on your home purchase simply by dropping or revising some of your must-haves and settling for OK-to-haves instead. For example, do you really need two bathrooms and a large backyard? Or could you settle for a single bathroom with space to add a second one in the future? And would a small garden, cozy balcony, or rooftop terrace still give you the outdoor time you crave? These types of compromises can sometimes shave tens of thousands off your purchase price. Similarly, if you don't mind rolling up your sleeves or working with a contractor on minor jobs, you can look for homes that need a little TLC. Just because a house looks dated doesn't mean it's destined to stay that way or that it will take a ton of money to spruce up. In fact, a home with good bones but cosmetic flaws could be a perfect match: With less competition, you'll have a better chance of purchasing the home at an affordable price. You can then take your time to save more and fix it up to your taste. Keep in mind, starter homes are rarely forever homes, but merely a first step onto the property ladder. By gaining a foothold in the real estate market now, you can set yourself up to afford a more expensive property in the future. According to the National Association of Realtors, in 2021, the net worth of a typical homeowner was $300,000, while that of a renter was only $8,000.9 We can help you find an affordable first home so you can start building equity to reach your long-term financial and real estate goals. YOU CAN DO IT—AND WE CAN HELP Buying a first home is challenging, but it's not impossible—especially when you have a savvy real estate professional in your corner. We will work with you to devise a plan to overcome your financial constraints. Then, we’ll help you find a home that not only excites you but also fits your budget and lifestyle. Give us a call to get started with a free exploratory consultation. *The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: Housing Wire -https://www.housingwire.com/articles/housing-affordability-ends-2022-at-record-low/ Realtor.com -https://www.realtor.com/news/trends/death-of-the-starter-home-where-have-all-the-small-houses-gone/ National Association of Realtors -https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers ValuePenguin -https://www.valuepenguin.com/mortgages/claiming-rental-income-for-mortgage Pew -https://www.pewresearch.org/fact-tank/2022/07/20/young-adults-in-u-s-are-much-more-likely-than-50-years-ago-to-be-living-in-a-multigenerational-household/ YouGov -https://today.yougov.com/topics/economy/articles-reports/2022/05/25/american-homebuyers-finanancial-help-parents Bankrate -https://www.bankrate.com/mortgages/first-time-homebuyer-grants/#types Investopedia -https://www.investopedia.com/terms/f/fhaloan.asp National Association of Realtors -https://www.nar.realtor/sites/default/files/documents/2022-snapshot-of-race-and-home-buying-in-the-us-04-26-2022.pdf

Take Advantage of Your Home Equity: A Homeowner’s Guide

Homeownership offers many advantages over renting, including a stable living environment, predictable monthly payments, and the freedom to make modifications. Neighborhoods with high rates of homeownership have less crime and more civic engagement. Additionally, studies show that homeowners are happier and healthier than renters, and their children do better in school.1 But one of the biggest perks of homeownership is the opportunity to build wealth over time. Researchers at the Urban Institute found that homeownership is financially beneficial for most families,2 and a recent study showed that the median net worth of homeowners can be up to 80 times greater than that of renters in some areas.3 So how does purchasing a home help you build wealth? And what steps should you take to maximize the potential of your investment? Find out how to harness the power of home equity for a secure financial future. WHAT IS HOME EQUITY? Home equity is the difference between what your home is worth and the amount you owe on your mortgage. So, for example, if your home would currently sell for $850,000, and the remaining balance on your mortgage is $400,000, then you have $450,000 in home equity. $850,000 (Home’s Market Value) - $400,000 (Mortgage Balance) ______________________________ $450,000 (Home Equity) The equity in your home is considered a non-liquid asset. It’s your money; but rather than sitting in a bank account, it’s providing you with a place to live. And when you factor in the potential of appreciation, an investment in real estate will likely offer a better return than any savings account available today. HOW DOES HOME EQUITY BUILD WEALTH? A mortgage payment is a type of “forced savings” for home buyers. When you make a mortgage payment each month, a portion of the money goes towards interest on your loan, and the remaining part goes towards paying off your principal, or loan balance. That means the amount of money you owe the bank is reduced every month. As your loan balance goes down, your home equity goes up. Additionally, unlike other assets that you borrow money to purchase, the value of your home generally increases, or appreciates, over time. For example, when you pay off your car loan after five or seven years, you will own it outright. But if you try to sell it, the car will be worth much less than when you bought it. However, when you purchase a home, its value typically rises over time. So when you sell it, not only will you have grown your equity through your monthly mortgage payments, but in most cases, your home’s market value will be higher than what you originally paid. And even if you only put down 10% at the time of purchase—or pay off just a small portion of your mortgage—you get to keep 100% of the property’s appreciated value. That’s the wealth-building power of real estate.WHAT CAN I DO TO GROW MY HOME’S EQUITY FASTER? Now that you understand the benefits of building equity, you may wonder how you can speed up your rate of growth. There are two basic ways to increase the equity in your home: 1. Pay down your mortgage.We shared earlier that your home’s equity goes up as your mortgage balance goes down. So paying down your mortgage is one way to increase the equity in your home. Some homeowners do this by adding a little extra to their payment each month, making one additional mortgage payment per year, or making a lump-sum payment when extra money becomes available—like an annual bonus, gift, or inheritance. Before making any extra payments, however, be sure to check with your mortgage lender about the specific terms of your loan. Some mortgages have prepayment penalties. And it’s important to ensure that if you do make additional payments, the money will be applied to your loan principal. Another option to pay off your mortgage faster is to decrease your amortization period. For example, if you can afford the larger monthly payments, you might consider refinancing from a 30-year or 25-year mortgage to a 15-year mortgage. Not only will you grow your home equity faster, but you could also save a bundle in interest over the life of your loan.2. Raise your home’s market value. Boosting the market value of your property is another way to grow your home equity. While many factors that contribute to your property’s appreciation are out of your control (e.g. demographic trends or the strength of the economy) there are things you can do to increase what it’s worth. For example, many homeowners enjoy do-it-yourself projects that can add value at a relatively low cost. Others choose to invest in larger, strategic upgrades. Keep in mind, you won’t necessarily get back every dollar you invest in your home. In fact, according to Remodeling Magazine’s latest Cost vs. Value Report, the remodeling project with the highest return on investment is a garage door replacement, which costs about $3600 and is expected to recoup 97.5% at resale. In contrast, an upscale kitchen remodel—which can cost around $130,000—averages less than a 60% return on investment.4 Of course, keeping up with routine maintenance is the most important thing you can do to protect your property’s value. Neglecting to maintain your home’s structure and systems could have a negative impact on its value—therefore reducing your home equity. So be sure to stay on top of recommended maintenance and repairs. HOW DO I ACCESS MY HOME EQUITY IF I NEED IT? When you put your money into a checking or savings account, it’s easy to make a withdrawal when needed. However, tapping into your home equity is a little more complicated. The primary way homeowners access their equity is by selling their home. Many sellers will use their equity as a downpayment on a new home. Or some homeowners may choose to downsize and use the equity to supplement their income or retirement savings. But what if you want to access the equity in your home while you’re still living in it? Maybe you want to finance a home renovation, consolidate debt, or pay for college. To do that, you will need to take out a loan using your home equity as collateral. There are several ways to borrow against your home equity, depending on your needs and qualifications:5 Second Mortgage - A second mortgage, also known as a home equity loan, is structured similarly to a primary mortgage. You borrow a lump-sum amount, which you are responsible for paying back—with interest—over a set period of time. Most second mortgages have a fixed interest rate and provide the borrower with a predictable monthly payment. Keep in mind, if you take out a home equity loan, you will be making monthly payments on both your primary and secondary mortgages, so budget accordingly. Cash-Out Refinance - With a cash-out refinance, you refinance your primary mortgage for a higher amount than you currently owe. Then you pay off your original mortgage and keep the difference as cash. This option may be preferable to a second mortgage if you have a high-interest rate on your current mortgage or prefer to make just one payment per month. Home Equity Line of Credit (HELOC) - A home equity line of credit, or HELOC, is a revolving line of credit, similar to a credit card. It allows you to draw out money as you need it instead of taking out a lump sum all at once. A HELOC may come with a checkbook or debit card to enable easy access to funds. You will only need to make payments on the amount of money that has been drawn. Similar to a credit card, the interest rate on a HELOC is variable, so your payment each month could change depending on how much you borrow and how interest rates fluctuate. Reverse Mortgage - A reverse mortgage enables qualifying seniors to borrow against the equity in their home to supplement their retirement funds. In most cases, the loan (plus interest) doesn’t need to be repaid until the homeowners sell, move, or are deceased.6 Tapping into your home equity may be a good option for some homeowners, but it’s important to do your research first. In some cases, another type of loan or financing method may offer a lower interest rate or better terms to fit your needs. And it’s important to remember that defaulting on a home equity loan could result in foreclosure. Ask us for a referral to a lender or financial adviser to find out if a home equity loan is right for you. WE’RE HERE TO HELP YOU Wherever you are in the equity-growing process, we can help. We work with buyers to find the perfect home to begin their wealth-building journey. We also offer free assistance to existing homeowners who want to know their home’s current market value to refinance or secure a home equity loan. And when you’re ready to sell, we can help you get top dollar to maximize your equity stake. Contact us today to schedule a complimentary consultation! *The above references an opinion and is for informational purposes only. It is not intended to be financial advice. Consult a financial professional for advice regarding your individual needs. Sources: National Association of Realtors -https://www.nar.realtor/blogs/economists-outlook/highlights-from-social-benefits-of-homeownership-and-stable-housing Urban Institute - https://www.urban.org/urban-wire/homeownership-still-financially-better-renting Census Bureau -https://www.census.gov/library/stories/2019/08/gaps-in-wealth-americans-by-household-type.html Remodeling Magazine -https://www.remodeling.hw.net/cost-vs-value/2019/ Investopedia -https://www.investopedia.com/mortgage/heloc/home-equity/ Bankrate -https://www.bankrate.com/mortgage/reverse-mortgage-guide/

Stress-Free Home Cleaning: 27 Practical Tactics for Busy Households

Keeping a clean and orderly home is a challenge for many of us. Between busy work schedules, social obligations, and family commitments, it’s tough to keep up with daily chores—let alone larger seasonal tasks. The effort is worthwhile, however. A sanitary environment can keep you and your family healthier by minimizing your exposure to germs and allergens.1 Plus, researchers have found that organized, uncluttered homes have quantifiable mental health benefits, too, including reduced stress, improved emotional regulation, and increased productivity.2 The reality is, we enjoy our homes more when they are in good order. It’s much easier to relax without piles of unopened mail or a messy kitchen reminding us of work to be done. And don’t we all feel more inclined to entertain family and friends when our homes are well-kept? That’s why we’ve rounded up our favorite tactics—from overall strategies to little tips and tricks—for keeping things tidy without spending all our spare time cleaning. Set a Schedule for Daily and Weekly Cleaning We’ve all been there—you put off vacuuming or mopping your floor for a few days, only to realize that weeks have passed. Creating a cleaning schedule that works for you is the best way to stay on top of things and avoid overwhelm. Here are a few of our favorite strategies: Designate a day of the week for each task—then, add them to your calendar so you can’t forget. Create a shared schedule that assigns specific responsibilities to each member of the household. Post it in a prominent place, like on the refrigerator, or create a shared digital calendar. Carve out 15 minutes a day for cleaning and decluttering. Set a timer on your phone and get as much done as you can before it goes off. It may take some trial and error to find the tactics that work best for you. The most important thing is to make a habit of cleaning so that clutter and grime don’t have a chance to build. And if you’d like some professional help, reach out for a referral to one of our favorite cleaning services! Tackle Bigger Chores Seasonally Many home care tasks are seasonal by nature and only need to be completed once or twice a year. But when we don’t have a plan to tackle them, it’s all too easy to put them off. Here are a few tips to stay on top of these chores: Mark days on your calendar in advance to attend to annual or semi-annual chores, like cleaning gutters, washing windows, turning mattresses, and shampooing carpets. Schedule just one primary task each weekend instead of blocking out a full two days. This will help ensure a good balance between chores and relaxation. Designate a date two to four times a year, depending on your lifestyle, to put away out-of-season items like clothes, holiday decorations, and sporting goods. Take some time to sort through your seasonal items when you pack them away. Then you can toss, sell, or donate items that you no longer need or enjoy. Remember—breaking down these larger tasks can make them less overwhelming. If you space them out so that you can handle them one by one, even the most time-consuming chores become a lot more manageable. And since all your time is valuable, don't hesitate to delegate these larger home care tasks to professionals. Give us a call for a list of our recommended service providers. Reduce the Barriers to Cleaning Set yourself up for success by ensuring you have the tools on hand to tackle small tasks with ease. Here are a few ways to make your cleaning supplies more accessible: Store a broom, dustpan, and vacuum on each floor of your home so they’re easy to reach. Stash containers of disinfecting and glass wipes under every sink for a mid-week wipe-down. Place extra bags beneath the liner of your garbage pails, so you’ll have a replacement ready when you take out the trash. Keep a paper shredder and recycling bin handy so you can dispose of unwanted mail as it’s opened. By strategically placing your tools and supplies in the locations where you’re most likely to need them, you’ll make cleaning less of a chore and more of a habit. Stop the Clutter Before It Starts From coats to shoes to mail, it’s all too easy to find clutter taking over your home. Once these piles start to form, they can feel overwhelming—which only makes it harder to address them. To avoid this problem, stop the clutter before it starts. Assign every item a home and create storage spaces and “drop zones” in key locations.3 Here are a few ideas to get you started: Install coat hooks and shoe racks in the entryway for easy access. Add a key caddy or shelf for essential items to get you out the door. Hang a letter bin to capture mail and newspapers as soon as you walk into the house. Place a donation box in each closet for items you no longer want or need. It can take a little time to get in the habit of returning items to their assigned space. But once you do, staying on top of clutter will become far more manageable. Are you considering a larger organizational upgrade, like a custom closet or pantry system? Reach out for a free consultation to find out how the investment could impact the value of your home! Tackle Small Tasks Right Away Sometimes, the mental load of thinking about a chore you need to do is worse than the chore itself. Plus, handling small tasks right away can reduce the need for lengthy cleaning sessions.3 Try working these changes into your routine: Learn to clean as you cook, rather than piling it all up for later. As you wait for water to boil or food to cook through, wash the bowls and utensils you used for prep. Hang bath towels on a bar immediately after use. By allowing them to properly air dry, you can cut down on the frequency of laundering. Bring items with you when you leave a room. For example, return plates and cups to the kitchen right away rather than letting them stack up in your home office. Take out the trash when you leave for work, school drop-off, or errands. This will save you the time and hassle of a second trip. If you implement these small changes, your home will stay neater—and you’ll minimize the number of dedicated cleaning sessions you need to take on each week. Embrace an Evening “Shutdown” Routine Kitchens can get dirty and cluttered fast. But a few minutes spent cleaning up each evening can prevent the mess from getting out of control.4 Imagine your kitchen is a restaurant and you’re tidying it up before closing down for the night. These simple steps will prepare you for the morning rush: Wipe down all surfaces, including countertops, stove, microwave, and sink. Then toss your soiled washcloth in the hamper and lay out a fresh one for tomorrow. Load and run the dishwasher every night so you can empty it the next morning. Prepare for breakfast by programming your coffee pot and setting out some grab-and-go options. We all know it can be hard to find the energy for chores in the evening. But if you complete these small tasks each night, you’ll start the next day off right in a tidy, clean kitchen. Think Outside of the Box When It Comes to Storage Most of us have limited storage space. Unfortunately, without the right spots to stash our items, it’s easy to become disorganized. But we’ve found that using household items in innovative ways can help keep mess and clutter under control.5 Here are a few of our favorite swaps: Place a magazine file in your kitchen for cookbooks, takeout menus, and meal kit cards. Hang a pocket-style shoe organizer inside your pantry door to store granola bars, spice jars, and other small items. Separate dress and athletic socks by turning an old shoe box into a drawer divider. Repurpose jam jars by using them to store office supplies or bathroom essentials. Store out-of-season clothes inside rarely-used suitcases, so all that space doesn’t go to waste. A little creativity goes a long way when it comes to making the most of your space. Just be sure that you’re creating systems you can stick with and not putting things where you might forget about them later! WE’RE HERE TO HELP YOU MAKE THE MOST OF YOUR HOME Keeping your home clean and organized can be a continuous struggle—there’s no need to feel ashamed of that. But taking the time to implement systems that work for you can make life more pleasant and less stressful in the long run. Remember, we’re not just here to help you buy or sell a home. We want you to love living in it, too. Reach out if you need referrals for house cleaners, window washers, or other service providers that can help you make the most of your space. *The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: Healthline -https://www.healthline.com/health-news/5-health-benefits-of-spring-cleaning Forbes - https://www.forbes.com/health/mind/mental-health-clean-home/ My Domaine - https://www.mydomaine.com/house-cleaning-schedule Housewife How-Tos - https://housewifehowtos.com/clean/10-tips-to-keeping-a-clean-house/ Better Homes and Gardens -https://www.bhg.com/decorating/storage/projects/simple-solutions/

Categories

Recent Posts