Could Lower Mortgage Rates Be on the Horizon for You?

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The prevailing expectation is that they’ll reduce the Federal Funds Rate at their upcoming meeting, primarily due to recent indications that inflation is easing and the job market is slowing. Mark Zandi, Chief Economist at Moody’s Analytics, remarked:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But what does this mean for the housing market, and more importantly, for you as a potential homebuyer or seller?

Why a Federal Funds Rate Cut Matters

The Federal Funds Rate is a key factor influencing mortgage rates, although other elements like the economy and geopolitical events also play a role.

When the Fed reduces the Federal Funds Rate, it reflects broader economic trends, and mortgage rates usually adjust in response. While a single rate cut might not result in a significant drop in mortgage rates, it could contribute to the gradual decline that’s already underway.

Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), notes:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

Moreover, any anticipated Federal Funds Rate cut is likely to be part of a broader trend. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), adds:

“Generally, the rate-cutting cycle is not one-and-done. Six to eight rounds of rate cuts all through 2025 look likely.”

The Projected Impact on Mortgage Rates

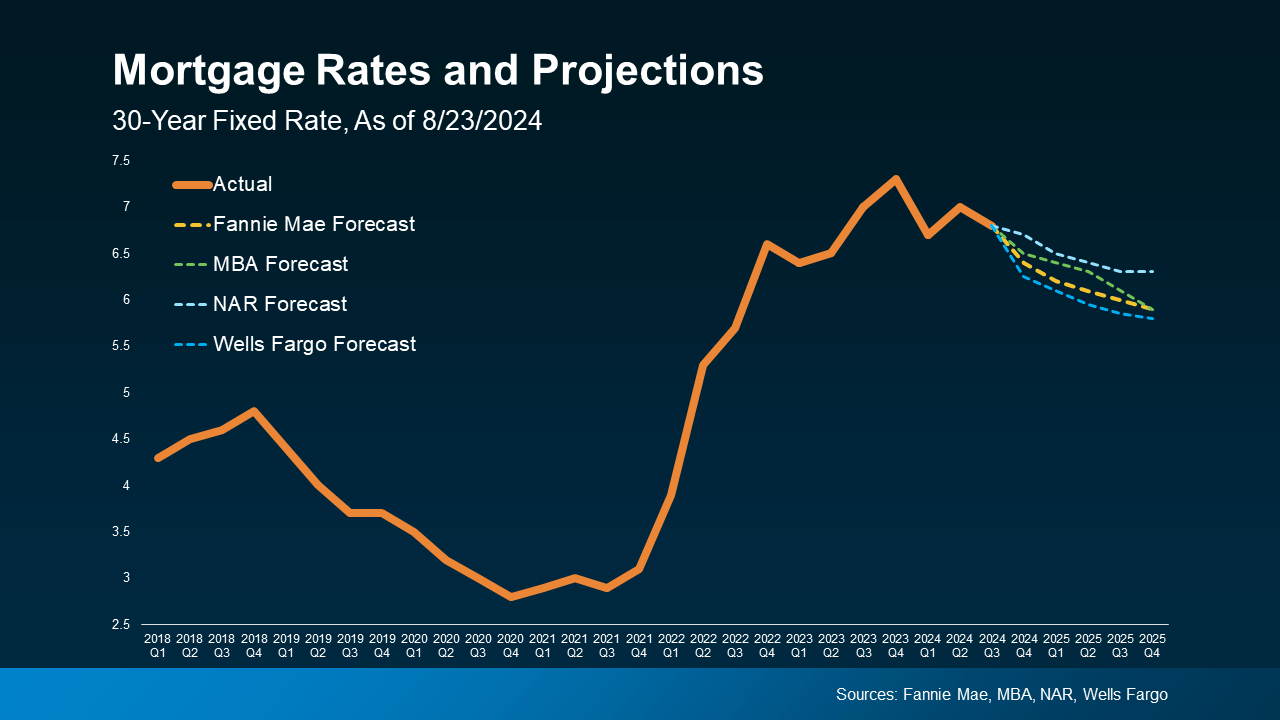

Experts predict that mortgage rates will continue to decline gradually through 2025, aided by the expected cuts from the Fed. The following graph illustrates the latest forecasts from Fannie Mae, MBA, NAR, and Wells Fargo (see graph below):

Given recent improvements in inflation and signs of a cooling job market, a Federal Funds Rate cut is likely to result in a moderate reduction in mortgage rates (as shown by the dotted lines). Here are two key reasons why this is beneficial for both buyers and sellers:

- It Helps Alleviate the Lock-In Effect

For current homeowners, lower mortgage rates might help reduce the lock-in effect. This is where people feel trapped in their current home because today’s rates are higher than their existing mortgage rate.

If the concern about losing a favorable mortgage rate has kept you from selling, a slight decrease in rates could make moving more appealing. However, this is unlikely to result in a surge of sellers, as many homeowners may still hesitate to give up their low-rate mortgages.

- It Should Boost Buyer Activity

For prospective homebuyers, a drop in mortgage rates makes the housing market more attractive. Lower rates can lower the overall cost of homeownership, making it more feasible for you if you’ve been waiting to make a purchase.

What Should You Do?

While a Federal Funds Rate cut may not lead to dramatic reductions in mortgage rates, it will likely support the ongoing gradual decline.

Given the anticipated rate cut’s potential to positively impact the housing market, it’s crucial to evaluate your options now. Jacob Channel, Senior Economist at LendingTree, puts it succinctly:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

The expected Federal Funds Rate cut, driven by easing inflation and slower job growth, is likely to positively influence mortgage rates, albeit gradually. This could create new opportunities for you. When you're ready to take action, reach out to The Studnicka Group. Our expert team is here to guide you through the process and help you make the most of the current market conditions.

Want to know what your home is currently worth? Click the link below to request a free home value assessment! 🏡👇

Partner with The Studnicka Group, your local housing market experts, to ensure you have the professional guidance you need as you explore the possibilities in your area!

Contact Us:

Phone: (310) 994-6034

Email: thestudnickagroup@gmail.com

Website: thestudnickagrpsellslaluxury.com

Categories

Recent Posts