Mid-Year Market Update for 2024: What Buyers and Sellers Need to Know

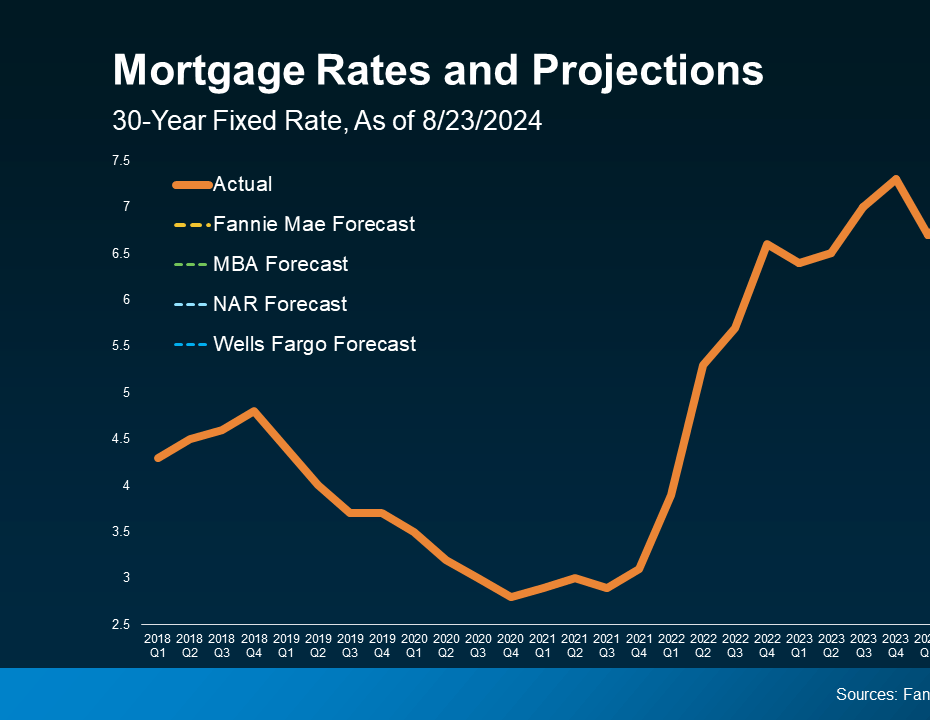

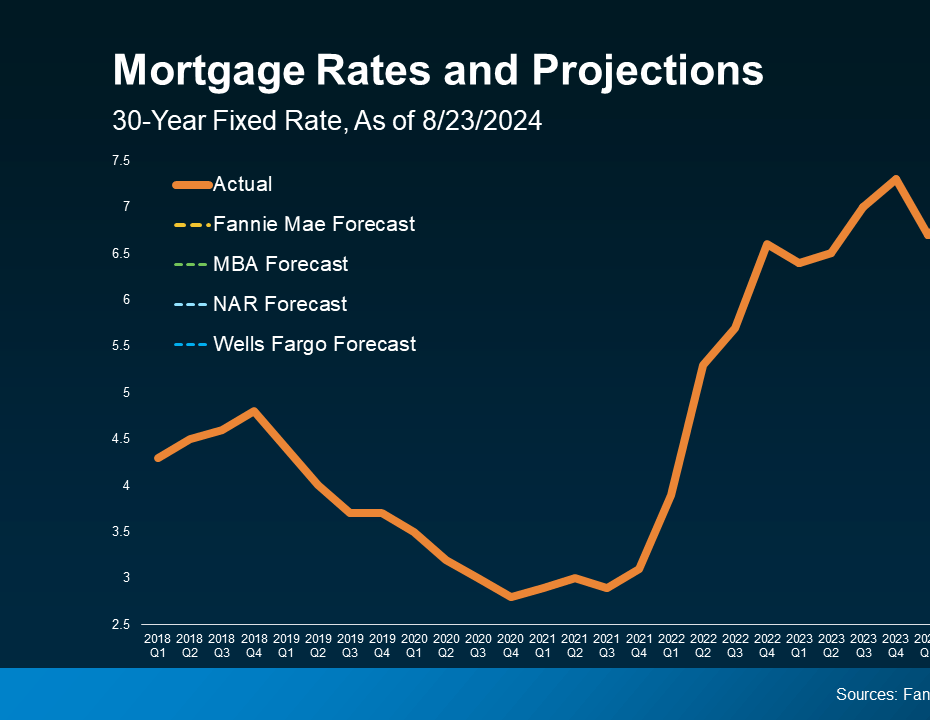

Last December, when the Federal Reserve projected a series of benchmark rate cuts in the coming year, some analysts speculated that mortgage rates—which had recently peaked near 8%—would fall closer to 6% by mid-2024.1,2,3 Unfortunately, persistent inflation has delayed the central bank’s timeline

Could Lower Mortgage Rates Be on the Horizon for You?

Now that it’s September, all eyes are on the Federal Reserve (the Fed). The prevailing expectation is that they’ll reduce the Federal Funds Rate at their upcoming meeting, primarily due to recent indications that inflation is easing and the job market is slowing. Mark Zandi, Chief Economist at Mood

7 Weekend Projects To Boost Your Property Value

Whether you’re putting your home on the market in a few weeks or a few years, strategic upgrades can make all the difference. But you don’t have to embark on a major remodel to make a significant improvement. Even minor updates can have a big impact on your home’s aesthetic, and certain renovations

Categories

Recent Posts