7 Common Homebuyer Regrets (And How To Avoid Them)

To avoid buyer's remorse, be sure to consider your future self when shopping for a home. Most new homebuyers don't regret becoming homeowners. In fact, according to a survey by LendingTree, 80% of recent buyers who successfully overcame a challenging housing market say they're glad they found their

Renovate or Relocate? 3 Questions to Help You Decide

Does your current home no longer serve your needs? If so, you may be torn between relocating to a new home or renovating your existing one. This can be a difficult choice, and there’s a lot to consider—including potential costs, long-term financial implications, and quality of life. A major remodel

National Real Estate Market Update for 2023

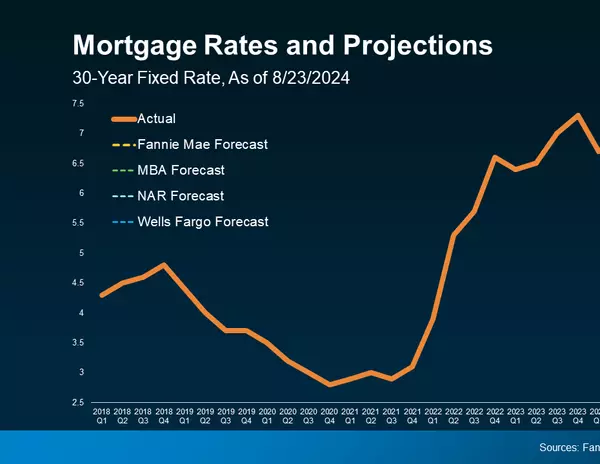

There’s an old adage in real estate: location, location, location. But ever since the Federal Reserve began its series of inflation-fighting interest rate hikes last year, a new mantra has emerged: mortgage rates, mortgage rates, mortgage rates. Higher rates had the immediate impact of dampening ho

Categories

Recent Posts