New Build or Existing Home: Which One Is Right for You?

Homebuyers today are facing a huge dilemma. There simply aren’t enough homes for sale.1 Nationwide, there were 1.27 million active listings in September, down 13% from the previous year. According to the National Association of Realtors, that’s about 2.4 months of inventory, which is far less than t

Shut Down Home Intruders With These 7 Safety Strategies

According to the FBI, more than one million burglaries are committed in the United States each year, with victims suffering an estimated $3 billion in combined property losses.1 Fortunately, there are some proven tactics you can use to decrease your likelihood of a home invasion. Most burglars won’t

5 Factors That Reveal Where The Real Estate Market Is Really Headed

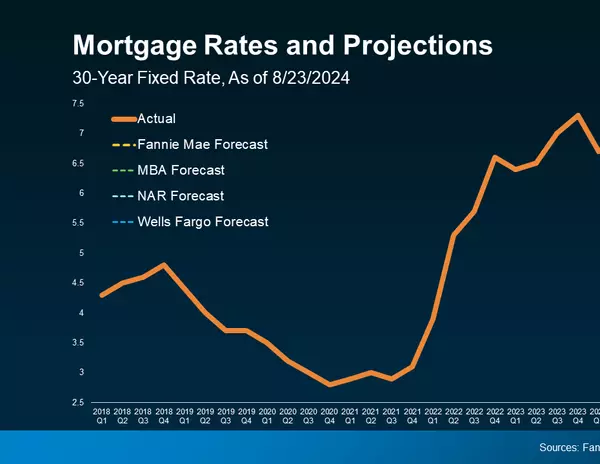

It’s the old supply-and-demand predicament: Home sales in the U.S. Real Estate Market continue at a torrid pace, but the availability of listings remains limited. Buoyed by historically low mortgage rates, buyers keep shopping for homes, reducing the available inventory and sparking a rise in home p

Categories

Recent Posts