Seller’s Checklist: A Timeline to Prep Your Home for Sale

We’re still in a seller’s market, but that doesn’t mean your home is guaranteed to easily sell.1 If you want to maximize your sale price, it’s still important to prepare your home before putting it on the market. Start by connecting with a real estate agent as soon as possible. Having the eyes and ears of an insightful real estate professional on your side can help you boost your home’s appeal to buyers. What’s more, beginning the preparation process early allows you to tackle repairs and upgrades that can increase your property’s value. Use the checklist below to figure out what other tasks you should complete in the months leading up to listing your home. While everyone’s situation is unique, these guidelines will help you make sure you’re ready to sell when the time is right. Of course, you can always call us if you’re not sure where to start or what to tackle first. We can help customize a plan that works for you. AS SOON AS YOU THINK OF SELLING Some home sellers want to plan their future move far in advance, while others will be required to pack up on very short notice. Whatever your circumstances, these first steps will help assure you’ll be ahead of the listing game. Contact Your Real Estate Agent We go the extra mile when it comes to servicing our clients, and that includes a series of complimentary, pre-listing consultations to help you prepare your home for the market. Some sellers make the mistake of waiting until they are ready to list their home to contact a real estate agent. But we’ve found that the earlier we’re brought into the process, the better the result. That often means a faster sale—and more money in your pocket after closing. We know what buyers want in today’s market, and we can help devise a plan to maximize your property’s appeal. We can also connect you with our trusted network of contractors, vendors, and service professionals, so you’ll be sure to get the VIP treatment. This network of support can alleviate stress and help ensure you get everything done in the weeks or months leading up to listing. Address Major Issues and Upgrades In most cases, you won’t need to make any major renovations before you list. But if you’re selling an older home, or if you have any doubt about its condition, it’s best to get us involved as soon as possible so we can help you assess any necessary repairs. In some instances, we may recommend a pre-listing inspection. Although it's less common in a seller's market, a pre-listing inspection can help you avoid potential surprises down the road. We can discuss the pros and cons during our initial meeting. This is the time to address major structural, systems, or cosmetic issues that could hurt the sale of your home down the line. For example, problems with the frame, foundation, or roof are likely to be flagged on an inspection report. Issues with the HVAC system, electrical wiring, or plumbing may cause the home to be unsafe. And sometimes outdated or unpopular design features can limit a home’s sales potential. Remember, when you’re dealing with major repairs or renovations, it’s best to give yourself as much time as possible. Given rampant labor and material shortages, starting right away can help you avoid costly delays.2 Contact us so we can guide you on the updates that are worth your time and investment. 1 MONTH (OR MORE) BEFORE YOU LIST Once any large-scale renovations have been addressed, you can turn your attention to the more minor updates that still play a major role in how buyers perceive your home. Make Minor Repairs Look for any unaddressed maintenance or repair issues, such as water spots, pest activity, and rotten siding. This is the time to take care of those small annoyances like squeaky hinges, sticking doors, and leaky faucets, too. Many of these issues can be handled by going the DIY route and using a few simple tools. Tackle the ones you can and be sure to call a professional for the ones you’re not comfortable doing yourself. We can refer you to local service providers who can help. Remember that it’s easy to overlook these small issues because you live with them. When you work with us, you get a fresh set of eyes on your home—so you don’t miss any important repairs that could make a big difference to buyers. Refresh Your Design This is a great time to think about some simple design updates that can make a significant impression on buyers. For example, a fresh coat of paint is an easy and affordable way to spruce up your home. One survey found that interior paint offered a 107% return on investment.3 For broad appeal, opt for warm, neutral colors. And never underestimate the importance of good curb appeal. Homes with good curb appeal sell for 7% more, on average, than similar homes with an “uninviting exterior.”4 If weather permits, lay fresh sod where needed, plant colorful flowers, and add some new mulch to your beds. Even just repositioning your furniture can make a huge difference to buyers. A survey by the Real Estate Staging Association found that staged homes sold faster, and 73% sold over list price.5 We can refer you to a local stager or offer our insights and suggestions if you prefer the DIY route. Declutter and Depersonalize Doing a little bit of decluttering every day is a lot easier than trying to take care of it all at once right before your home hits the market. A simple strategy is to do this one room at a time, working your way through each space whenever you have a bit of free time. Start by donating or discarding items that you no longer want or need. Then pack up any seasonal items, family photos, and personal collections you can live without for the next few weeks. Bonus: This will give you a head start on packing for your move! 1 WEEK BEFORE YOU GO TO MARKET With just one week before your home is available for sale, all major items should be crossed off your to-do list. Now it’s time to focus on the small details that will really make your home shine. Here are a few key areas to focus on during this last week. Check-In With Your Agent We’ll connect again to make sure we’re aligned on the listing price, marketing plan, and any remaining prep. We will be there every step of the way, ensuring you’re fully prepared to maximize the sale of your home. Tidy Your Exterior You’ve already done the major landscaping—now it’s time to tackle the last few details. Make sure your lawn is freshly mowed, hedges are trimmed, and flower beds are weeded. In addition, now is the time to clean your home’s exterior if you haven’t already. Power wash your siding, empty the gutters, and wash all your windows and screens. Deep Clean Your Interior Your house should be deep cleaned before listing, including a thorough deodorizing of the home’s interior and steam cleaning for all carpets. Consider hiring a professional cleaning company to ensure the space smells and looks as fresh as possible. In addition to cleaning, take some time to tidy up. Buyers will look inside your closets, pantries, and cabinets, so make sure they are neat and organized. Small appliances and toiletries should be cleared off the countertops. DAY OF SHOWING Now you’re all set to go and there are just a few small things you need to handle on the day of showings or open houses. Do a final walk-through and take care of these finishing touches to give potential buyers the best possible impression. Pre-Showing Prep Happy and comfortable buyers are more likely to submit offers! Make them feel at home by adjusting the thermostat to a comfortable temperature. Open any blinds and curtains throughout the house, and turn on all lights so buyers can see all the potential in your home. Then tidy up by vacuuming and sweeping floors, emptying (or hiding) trash cans, and wiping down countertops. In the bathrooms, close toilet lids and hang clean hand towels. Don’t forget to secure firearms, jewelry, sensitive documents, prescription medications, and any other items of value in a safe or store them off-site. Finally, it’s best to have pets out of the house during showings. If possible, you should also remove evidence of pets (litter box, dog beds, etc.), which can be a turn-off for some buyers. DON’T WAIT TO PREP YOUR HOME FOR SELLING If you want to get top dollar for your home, don’t put it on the market before it’s ready. The right preparation can make all the difference when it comes to maximizing the offers you get. The upgrades and changes you need to make will depend upon your home’s condition, so don’t wait to speak with an agent. Call our team if you’re thinking about selling your home, even if you’re not sure when. It’s never too early to seek the guidance of your real estate agent and start preparing your home to sell. Sources: Fortune -https://fortune.com/2022/02/08/should-i-buy-house-sellers-market-housing-real-estate-fannie-mae/ Forbes -https://www.forbes.com/advisor/home-improvement/labor-materials-shortage-impacts-renovations/ PR Web -https://www.prweb.com/releases/2012-homegain/home-improvement-survey/prweb9433460.htm Realtor Magazine -https://magazine.realtor/daily-news/2020/01/27/how-much-does-curb-appeal-affect-home-value Real Estate Staging Association -https://www.realestatestagingassociation.com/content.aspx?page_id=22&club_id=304550&module_id=164548

Renters for a Weekend or a While: What’s the Best Use of Your Investment Property?

The residential rental market is now the fastest-growing segment of the housing market. In the United States, the demand for single-family rentals, defined as either detached homes or townhouses, has risen 30 percent in the past three years.1 And in Canada, rental units now account for nearly one-third of the country’s homes, with particular demand for multi-family units, including apartments and condominiums.2 At the same time, the short-term, or vacation, rental market is also booming. The popularity of online marketplaces like Airbnb, HomeAway, and VRBO has helped the short-term rental market become one of the fastest-growing segments in the travel industry.3 Now, more than ever, there is an abundance of opportunities for real estate investors. But which path is best: leasing your property to a long-term tenant, or renting your property to travelers on a short-term basis? In this post, we examine the differences between the two investment strategies and the benefits and limitations of each category. WHY INVEST IN A RENTAL PROPERTY? The Top 5 Reasons Before we delve into the differences between long-term and short-term rentals, let’s answer the question: “Why invest in a rental property at all?” There are five key reasons investors choose real estate over other investment vehicles: Appreciation Appreciation is the increase in your property’s value over time. And history has proven that over an extended period, the cost of real estate continues to rise. Recessions may still occur, but in the vast majority of markets, the value of real estate does grow over the long term. Cash Flow One of the key benefits of investing in real estate is the ability to generate steady cash flow. Rental income can be used to pay the mortgage and taxes on your investment property, as well as regular maintenance and repairs. If appropriately priced in a solid rental market, there may even be a little extra cash each month to help with your living expenses or to grow your savings. Even if you only take in enough rent to cover your expenses, a rental property purchase will pay for itself over time. As you pay down the mortgage every month with your rental income, your equity will continue to increase until you own the property free and clear … leaving you with residual cash flow for years to come. Hedge Against Inflation Inflation is the rate at which the general cost of goods and services rises. That means as inflation rises, the money you have sitting in a savings account will buy less tomorrow than it will today. On the other hand, the price of real estate typically matches (or often exceeds) the rate of inflation. To hedge or guard yourself against inflation, real estate can be a smart investment choice. LeverageLeverage is the use of borrowed capital to increase the potential return on investment. You can put a relatively small amount down on a property, finance the rest of the investment with a mortgage, and then profit on the entire combined value. Tax BenefitsDon’t overlook the tax benefits that can come with a real estate investment, as well. From deductions to depreciation to exemptions, there are many ways a real estate investment can save you money on taxes. Consult a tax professional to discuss your particular circumstances. These are just a few of the many perks of investing in real estate. (For more detailed information, visit our previous post: Why Real Estate Investing Makes (Dollars and) Sense. But what’s the best strategy to maximize returns on your investment property? In the next section, we explore the differences between long-term and short-term rentals. LONG-TERM (TRADITIONAL) RENTAL MARKET When most people think of owning a rental property, they imagine buying a home and renting it out to tenants to use as their primary residence. Traditionally, investors would use their rental property to generate an additional stream of income while benefiting from the property’s long-term appreciation in value. In fact, that steady and predictable monthly cash flow is one of the key advantages of owning a long-term rental. And as an owner, you don’t usually have to worry about paying the utility bills or furnishing the property—both of which are typically covered by the tenant. Add to this the fact that traditional tenants translate into less time and effort spent on day-to-day property management, and long-term rentals are an attractive option for many investors. However, there are also limitations to long-term rentals, which often come down to your ability to control the property. Perhaps the most obvious one is that you do not get to use the home or closely monitor its upkeep (this is different from a short-term rental, which we’ll share in the next section). In addition, while you can usually generate a steady, predictable income stream with a long-term rental, you are limited in your ability to adjust rent prices based on increasing or seasonal demand. Therefore, you may end up with a lower overall return on your investment. In fact, according to data from Mashvisor, in the 10 hottest real estate markets, short-term rentals produced “significantly higher rental income” than long-term rentals.4 SHORT-TERM (VACATION) RENTAL MARKET Short-term rentals are often referred to as vacation rentals, as more and more travelers enjoy the benefits of staying in a home while on vacation. In fact, according to Wells Fargo, vacation rentals are steadily growing and predicted to account for 21% of the worldwide accommodations market by 2020.5 Investing in a short-term rental or funding your second-home purchase by renting it out can offer many benefits. If you purchase an investment property in a top travel destination or vacation spot, you can expect steady demand from travelers while taking advantage of any non-rented periods to enjoy the home yourself. In addition to greater control over how your property is used, you can also adjust your rental price around peak travel demand to maximize your returns. But short-term rentals also have risks and drawbacks that may dissuade some investors. They require greater day-to-day property management, and owners are typically responsible for furnishing the property, upkeep, and utilities. And while rental revenue can be higher, it can also be less predictable based on seasonal or consumer travel trends. For example, a lack of snowfall during ski season could mean fewer bookings and lower rental revenue that year. In addition, laws and limitations on short-term rentals can vary by region. And in some areas, the regulations are in flux as residents and government officials adapt to a new surge in short-term rentals. So make sure you understand any existing or proposed restrictions on rentals in the area where you want to invest. Urban centers or suburban communities may be more resistant to short-term renters, thus more likely to pass future limitations on use. To lower your risk, you may want to consider properties in resort communities that are accustomed to travelers. We can help you assess the current regulations on short-term rentals in our area. Or if you’re interested in investing in another market, we can refer you to a local agent who can help. WHICH INVESTMENT STRATEGY IS RIGHT FOR YOU? Now that you understand these two real estate investment options, how do you pick the right one for you? It’s helpful to start by clarifying your investment goals. If your goal is to generate steady, predictable income with less time and effort spent on property management, then a long-term rental may be your best option. Also, if you prefer a less-risky investment with more reliable (but possibly lower) returns, then you may be more comfortable with a long-term rental. On the other hand, if your goal is to purchase a vacation or second home that you’ll use, and you want to defray some (or all) of the expense, then a short-term rental may be a good option for you. Similarly, if you’re open to taking on more risk and revenue volatility for the possibility of greater investment returns, then a short-term rental may better suit your spirit as an investor. But sometimes the decision isn’t always so clear-cut. If your goal is to purchase a future retirement home now to hedge against inflation, rising real estate prices, and interest rates, then both long- and short-term rentals could be suitable options. In this case, you’ll want to consider other factors like location, market demand, property type, and your risk tolerance. HERE OR ELSEWHERE … WE CAN HELP If you’re looking to make a real estate investment—whether it’s a primary residence, investment property, vacation home, or future retirement home—give us a call. We’ll help you determine the best course of action and share insights and resources to help you make an informed decision. And if your plans include buying outside of our area, we can refer you to a local agent who can help. Contact us to schedule a free consultation! *The above references an opinion and is for informational purposes only. It is not intended to be financial advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: USA Today – https://www.usatoday.com/story/money/personalfinance/real-estate/2017/11/11/renting-homes-overtaking-housing-market-heres-why/845474001/ The Globe and Mail – https://www.theglobeandmail.com/real-estate/the-market/article-demand-for-rental-housing-in-canada-now-outpacing-home-ownership/ Phocuswright – https://www.phocuswright.com/Travel-Research/Research-Updates/2017/US-Private-Accommodation-Market-to-Reach-36B-by-2018 Rented.com – https://www.rented.com/vacation-rental-best-practices-blog/do-long-term-rentals-or-short-term-rentals-provide-better-investment-returns/ Turnkey Vacation Rentals – https://blog.turnkeyvr.com/short-term-vs-long-term-vacation-rental-properties/

Higher Rates and Short Supply: The State of Real Estate in 2022

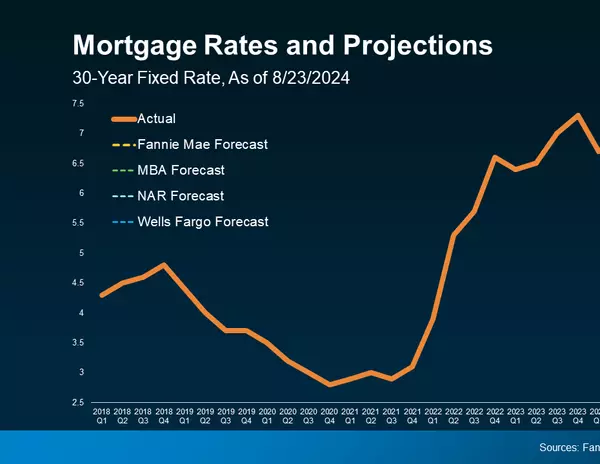

The last two years caught many of us off guard—and not just because of the pandemic. They also ushered in the hottest housing market on record, with home prices rising nationally by nearly 19% in 2021, driven primarily by low mortgage rates and a major supply shortage.1 But while some had hoped 2022 would bring a return to normalcy, the U.S. real estate market continues to boom, despite rising interest rates and decreasing affordability. So what’s driving this persistent demand? And is there an end in sight? Here are three factors impacting the real estate market right now. Find out how they could affect you if you’re a current homeowner or plan to buy or sell a home this year. MORTGAGE RATES ARE RISING FASTER THAN EXPECTED Over the past couple of years, homebuyers have faced intense competition for new homes—in part due to historically low mortgage rates that were a result of the Federal Reserve’s efforts to keep the economy afloat during the COVID-19 pandemic. However, in response to a concerning level of inflation, the Fed is now reversing those efforts by raising the federal funds rate. And as a result, mortgage rates are rising, as well. Few experts predicted, though, that mortgage rates would go up as quickly as they have. In January 2022, the Mortgage Bankers Association projected that rates would reach 4% by the end of this year.2 By mid-April, however, the average 30-year fixed mortgage rate had already hit 5%, up from around 3% just one year prior.3 On a $400,000 mortgage, that 2% difference could translate into an additional $461 per monthly payment. Since then, mortgage rates have continued on an upward trend. So what impact are these rising rates having on demand? While many buyers had hoped for a cooling effect, experts warn that may not be the case. Ali Wolf, chief economist at housing market research firm Zanda, told Fortune magazine, "Rising mortgage rates are having a counterintuitive effect on the housing market. Home shoppers are actually sprung into action in an attempt to buy a home before mortgage rates rise any higher."4 Since inventory remains low, the resulting “race” has kept the homebuying market highly competitive–at least for now. What does it mean for you? While current 30-year fixed mortgage rates represent an increase over previous months, they remain well below the historical average of 8%.5 As inflation across the economy continues, the Fed is likely to raise rates further this year. Buyers should act fast to secure a good mortgage rate. We’d be happy to refer you to a lender who can help. For sellers, speed is also of the essence. The pool of potential buyers may shrink as mortgages become more expensive. And if you plan to finance your next home, you’ll want to act quickly to secure a favorable rate for yourself. Contact us today to discuss your options. HOME PRICES KEEP CLIMBING History shows that higher interest rates don’t necessarily translate to lower home prices. In fact, home prices rose 5% between 1980 and 1982, a period of significantly higher mortgage rates and inflation.5 Forecasters expect that home prices will continue to go up throughout 2022, though likely at a slower pace than the 18.8% increase of the last 12 months.4 Bank of America predicts that prices will be up approximately 10% by the end of this year, while Fannie Mae estimates 11.2%.6,7 In addition to limited supply and a race to beat rising mortgage rates, home values are also climbing because of positive economic indicators, like low unemployment.8 Plus, rents are soaring–up 17% from a year ago–which is prompting more first-time homebuyers to enter the market.9 Add to that the continued popularity of remote work, and it’s easy to see why property prices continue to surge. However, it’s not all bad news for prospective homebuyers. Economists expect that as mortgage rates rise, the rate of appreciation will continue to taper, though the effect may be gradual. “Eventually mortgage rates will slow down home prices,” according to Ken Johnson, an economist at Florida Atlantic University interviewed by Marketwatch.10 “We should not see rapid upticks in prices as mortgage rates rise.” Forecasters agree—Fannie Mae expects price increases to slow to 4.2% in 2023.7 What does it mean for you? While the pace of appreciation is likely to decrease next year, home prices show no signs of going down. However, current labor shortages are leading to higher salaries and better job opportunities for many workers. You may find that your income growth outpaces home prices, making homeownership more affordable for you in the future. For homeowners, the outlook’s even brighter. You could find yourself sitting on a nice pile of equity. Contact us for a free home value assessment to find out. INVENTORY REMAINS EXTREMELY LOW As noted, one of the largest hurdles to homeownership is a lack of inventory. According to a February 2022 report by Realtor.com, there’s an expanding gap between household formation and home construction, which has resulted in a nationwide shortage of 5.8 million housing units.11 The origins of this shortage date back to the 2008 housing crisis, during which crashing home values led contractors to stop building new properties—a trend that has not been fully reversed.12 That decline in home construction also resulted in a decrease in the number of home building professionals, a trend that was exacerbated by job losses during the COVID-19 pandemic. Now, many builders are limited by their ability to find qualified labor. Another major challenge is a staggering increase in the cost of materials. Pandemic-related supply chain shortages have been a significant driver, with home building material costs rising on average 20% on a year-over-year basis. The price of framing lumber alone has tripled since August 2021.13 These trends add tens of thousands of dollars to the cost of a typical home. Factors like a lack of buildable land in many areas, restrictive zoning, and a shortage of developers are also contributing to the issue.14 Most homebuying experts agree that the lack of inventory is the primary factor driving rising housing prices and unprecedented competition for homes. With available housing units near four-decade lows, the end of the current housing boom is not yet in sight.15 What does it mean for you? Prospective buyers should be prepared to compete for a home, since low inventory can lead to multiple offers. You may also need to expand your search parameters. If you’re ready to look, we’re ready to help. For sellers, the picture is rosier. In this strong market, your home may be worth more than you realize. Contact us to find out how much your home could sell for in today’s market. WE’RE HERE TO GUIDE YOU While national real estate trends can provide a “big picture” outlook, real estate is local. And as local market experts, we can guide you through the ins and outs of our market and the local issues that are likely to drive home values in your particular neighborhood. If you’re considering buying or selling a home, contact us now to schedule a free consultation. We can help you assess your options and make the most of this unique real estate landscape. Sources: Marketwatch -https://www.marketwatch.com/picks/home-price-appreciation-will-normalize-what-5-economists-and-real-estate-pros-predict-will-happen-to-home-prices-in-2022-01646940841 Bankrate - https://www.bankrate.com/mortgages/mortgage-rate-forecast CNBC -https://www.cnbc.com/2022/04/16/heres-how-much-the-same-mortgage-costs-now-compared-to-last-year.html Fortune -https://fortune.com/2022/03/23/housing-market-interest-rate-economic-shock/ National Association of Realtors -https://www.nar.realtor/blogs/economists-outlook/instant-reaction-mortgage-rates-april-07-2022 Fortune -https://fortune.com/2022/03/16/home-prices-2022-2023-bank-of-america-forecast-mortgage-rates/ Fortune - https://fortune.com/2022/03/07/what-home-prices-will-look-like-2023-fannie-mae/ Fortune - https://fortune.com/2022/03/17/home-prices-drop-housing-markets-california-michigan-massachusetts-corelogic/ CNN - https://www.cnn.com/2022/03/23/success/us-national-rent-february/index.html MarketWatch -https://www.marketwatch.com/story/home-prices-increase-at-one-of-the-fastest-rates-on-record-but-higher-mortgage-rates-should-slow-future-growth-11648559497 Realtor.com -https://www.realtor.com/research/us-housing-supply-gap-expands/ NPR -https://www.npr.org/2022/03/29/1089174630/housing-shortage-new-home-construction-supply-chain Investopedia -https://www.investopedia.com/housing-market-dips-in-early-march-2022-5222449 NPR -https://www.npr.org/2022/03/29/1089174630/housing-shortage-new-home-construction-supply-chain Fortune -https://fortune.com/2022/03/14/housing-market-key-metric-inventory-zillow-bad-for-buyers/

Categories

Recent Posts