Renovate or Relocate? 3 Questions to Help You Decide

Does your current home no longer serve your needs? If so, you may be torn between relocating to a new home or renovating your existing one. This can be a difficult choice, and there’s a lot to consider—including potential costs, long-term financial implications, and quality of life. A major remodel can be a major commitment. From hiring contractors to selecting materials to managing a budget, it can take a tremendous amount of time and energy—not to mention the ordeal of living through construction or relocating to a temporary residence. On the other hand, moving is notoriously taxing. In fact, in one survey, 40% of respondents viewed buying a new home as ”the most stressful event in modern life.”1 So which is the better option for you? Let’s take a closer look at some of the factors you should consider before you decide. 1. What Are Your Motivations for Making a Change? It’s possible that some of the limitations of your current home can be addressed with a renovation, but others may require a move. Renovate Certain issues, like dated kitchens and bathrooms, are fairly easy to remedy with a remodel—and the results can be dramatic. In many cases, a relatively minor renovation can significantly increase your enjoyment of your home. Other shortcomings can be more challenging to fix but are worth exploring so that you know your options. For example, if your home feels cramped or it lacks certain rooms, you might be able to make changes like installing an extra bathroom, adding a dedicated office, or finishing an attic or basement. You may even be able to build an accessory dwelling unit or extension to accommodate a multi-generational family. In fact, many Americans have remodeled their homes to meet changing needs since the start of the pandemic. According to the National Association of the Remodeling Industry, 90% of their members reported increased demand for renovations starting in 2020, and 60% reported that the scale of remodeling projects has grown.2 However, the feasibility and cost of these larger changes will depend on factors ranging from zoning and permitting to your home’s current layout. Speaking with an architect or a contractor can help you make an informed decision. Let us refer you to one of our trusted partners to ensure you receive the best possible service. Relocate Of course, sometimes, even rebuilding your home from the ground up wouldn’t solve the problem. For example, moving may be the only solution if you’ve switched jobs and now face a lengthy commute or if you need to live closer to an aging family member. Conversely, if the shift to remote work has opened up your location options, you may wish to seize the opportunity to relocate to a new locale. A 2022 study found that nearly five million Americans had already moved since the start of the COVID-19 pandemic due to increased flexibility from remote work, and nearly 19 million more were planning to move in the near future for the same reasons.3 Moving may also be the best option, even when you’re happy with your geographic location. A local move may make sense if you’re looking for a larger backyard or significantly more space. Similarly, some frustrations—like living on a busy street or a long way from a grocery store—can’t be addressed with a renovation. We are well-versed in this area and can help you determine whether another neighborhood might suit you and your family better. 2. Which Option Makes the Most Financial Sense? Renovating and relocating both come with costs, and it’s wise to explore the financial implications of each choice before you move forward. Renovate The costs of a renovation can vary widely, so it’s vital to get several estimates from contractors upfront to understand what it might take to achieve your dream home. Be sure to consider all of the potential expenditures, from materials and permits to updates to your electrical and plumbing systems. It’s also prudent to add 10-20% to your total budget to account for unexpected issues.4 If you plan to DIY all or part of your renovation, don’t forget to factor in the value of your time. Renovations can also come with hidden expenses. These might include: Additional home insurance Short-term rental or hotel if you need to move out during the renovation Storage unit for possessions that need to be out of the way Dining out, laundry service, and other essentials if you can’t access appliances at home Remodeling choices can also impact the long-term value of your home. Some projects may increase your home’s value enough to outweigh your investment, while others could actually hurt your home’s resale potential. For example, although you may enjoy the additional living space, garage conversions aren’t typically popular with buyers.5 Refinishing hardwood floors, on the other hand, brings an average return of 147% at resale.2 The specific impact of a renovation will depend on a number of factors, including the quality of work, choice of materials, and buyer preferences in your area. We can help you assess how a planned project is likely to affect the value of your home. Relocate The cost of a new home, of course, will vary significantly depending on the features you’re seeking. However, you may find that it’s cheaper to move to a home that has everything you want than it is to make major changes to your existing one. For example, adding a downstairs bedroom suite or opening up a closed floor plan could cost you more than it would to buy a home that already has those features. On the other hand, simpler changes and updates probably won’t outweigh the expense of a relocation. If you’re considering a move, speak with a real estate agent early in the process. We can assess your current home’s value and estimate the price of a new home that meets your needs. This will help you set an appropriate budget and expectations. It’s important to remember that the cost of buying a new home doesn't end with the purchase price. You’ll also need to account for additional expenditures, including closing and moving costs and the fees involved with selling your current home. And don’t forget to compare current mortgage rates to your existing one to understand how a different rate could impact your monthly payment. However, keep in mind that the interest rate on a mortgage is typically lower than the rate on other loan types—so you could pay less interest on a new home purchase than you would on remodel.6 We’re happy to refer you to a lending professional who can help you explore your financing options. 3. Which Option Will Be the Least Disruptive to Your Life? A final—but critical—consideration is the time and hassle involved with each option since both renovating and relocating involve a significant amount of each. Renovate Don’t underestimate the time and effort involved in a large-scale renovation, even if you choose to hire a general contractor. You will still need to consider and make a number of decisions. For example, even a fairly basic kitchen remodel can involve a seemingly-endless selection of cabinets, tile, countertops, paint colors, fixtures, hardware, and appliances. And don’t assume that you will get out of packing and unpacking if you stay in your current home. Most renovations—from kitchens to bathrooms to flooring replacement—require you to remove your belongings during the construction process. The time frame for a remodel is another consideration. High demand for contractors and ongoing material shortages can mean a long wait to get started. And once the project is in progress, you can expect that it will take a couple of weeks to several months to complete.7 Contemplate whether you will be able to live in your home while it’s being renovated and how that would impact your routine. For example, being without a functional kitchen for months can be frustrating, inconvenient, and expensive (since you’ll need to purchase prepared food). Remember that delays are inevitable with construction, and consider what additional challenges they could present. Relocate Of course, finding a new home and selling your current one also takes a significant amount of time and energy. According to the National Association of Realtors’ 2022 Profile of Home Buyers and Sellers, the average buyer searched for 10 weeks and toured a median of five homes.8 However, in many cases, the timeline can still be shorter than a major renovation. Once you find a home that works for you, it typically takes between 30 and 60 days to close if you’re taking on a mortgage—and the process is even faster if you’re paying with cash.9 Plus, you can look for your dream home without the inconvenience of living in a construction zone. However, a move comes with its own stress and disruptions. If you’re selling your current home, you’ll need to prep it for the market and keep it ready and available for showings. Once you’ve found a place, the packing and moving process takes time and work, as does settling into a new home—especially if it’s in a different neighborhood. Fortunately, we are here to help make the moving process as easy as possible, if you choose to pursue that route. We can help you find a property that meets all your needs, sell your current one for top dollar, and refer you to some excellent moving companies that can help pack and transport your belongings. WHATEVER YOU DECIDE, WE CAN HELP The decision to renovate or relocate can be overwhelming—but this choice also presents a powerful opportunity to improve your quality of life. There’s a lot to consider, from how renovations could impact your home’s resale value down the road to your neighborhood’s current market dynamics. We’re happy to help you think through your options. Get in touch for a free consultation! *The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: HousingWire -https://www.housingwire.com/articles/46384-americans-say-buying-a-home-is-most-stressful-event-in-modern-life/ National Association of the Remodeling Industry -https://cdn.nar.realtor//sites/default/files/documents/2022-remodeling-impact-report-04-19-2022.pdf?_gl=1*3pfs0m*_gcl_au*NTU2MDQ0MzAyLjE2ODMyMzgzMTY Business Insider -https://www.businessinsider.com/5-million-people-moved-because-of-remote-work-since-2020-2022-3 Forbes -https://www.forbes.com/home-improvement/contractor/home-renovation-costs/ U.S. News & World Report -https://realestate.usnews.com/real-estate/articles/10-home-renovations-that-can-decrease-the-value-of-your-home Bankrate -https://www.bankrate.com/mortgages/mortgage-vs-home-equity-loan/#differences House Beautiful -https://www.housebeautiful.com/home-remodeling/a25588459/home-renovation-timeline/ National Association of Realtors -https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers Forbes -https://www.forbes.com/advisor/mortgages/how-long-does-it-take-to-close-on-a-house/

National Real Estate Market Update for 2023

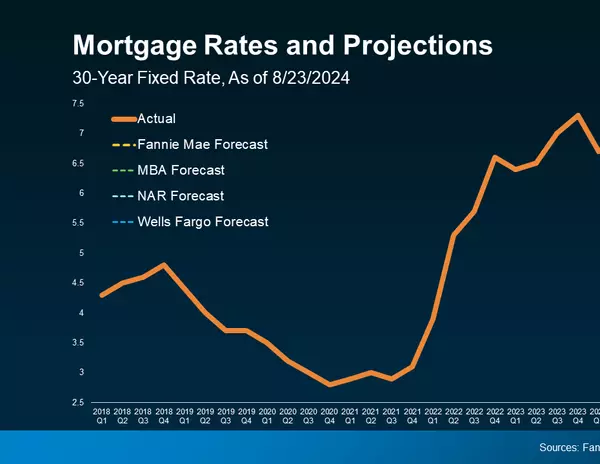

There’s an old adage in real estate: location, location, location. But ever since the Federal Reserve began its series of inflation-fighting interest rate hikes last year, a new mantra has emerged: mortgage rates, mortgage rates, mortgage rates. Higher rates had the immediate impact of dampening homebuyer affordability and demand. But this year, we’re seeing further repercussions. While analysts expected listing inventory to swell as sales declined, instead, homeowners have been pushing off plans to sell because they feel beholden to their existing, lower mortgage rates. So what impact is this reduced demand and low supply environment having on home values? And what can we expect from the real estate market in the coming months and years? Here are several key indicators that help to paint a picture of the current market and where it’s likely headed. HOME SALES ARE EXPECTED TO PICK UP BY EARLY NEXT YEAR The weather isn’t the only thing that heats up in the spring and summer. Nationally, it tends to be the busiest time in real estate. But this year, the peak season got off to a slow start, with sales declines in both March and April.1,2 Existing home sales in April were down 3.4% from the previous month—and 23.2% from a year earlier.2 What’s causing this market slowdown? Industry experts attribute it to several factors, including near-record home prices, high mortgage rates, and low inventory. According to National Association of Realtors (NAR) Chief Economist Lawrence Yun, “Home sales are trying to recover and are highly sensitive to changes in mortgage rates. Yet, at the same time, multiple offers on starter homes are quite common, implying more supply is needed to fully satisfy demand. It's a unique housing market.”1 However, some industry experts believe the market is poised for a comeback. Forecasters at the Mortgage Bankers Association (MBA) predict that home sales will continue to fall through Q3 before rising in Q4 and throughout next year.3 Analysts at Fannie Mae expect the recovery to take a bit longer, picking up in early 2024. Meanwhile, home builder confidence is already up, as purchases of new single-family homes surged in March and April to a 13-month high.5 Builder incentives are helping to boost sales: According to the National Association of Home Builders, in May, 54% reported using them to win over budget-conscious buyers.6 What does it mean for you? A slower pace of sales has given buyers some breathing room. If you hated the frenzy of the pandemic-era real estate market, now might be a better time for you to shop for a home. We can help you evaluate your options and make an informed purchase. If you plan to sell your home, prepare yourself for less foot traffic and a longer sales timeline than you may have found a year ago. It will also be crucial to enlist the help of a skilled agent who knows how to draw in buyers. Reach out for a copy of our multi-step Property Marketing Plan. PROPERTY VALUES REMAIN RELATIVELY STABLE Some good news for buyers: While home builder sales climbed in April, the median new-house price fell to $420,800, an 8.2% decrease from a year ago.5 Meanwhile, the median existing-home price dropped to $388,800, down 1.7% year-over-year. Notably, existing-home prices rose in parts of the country but fell in the South and West.2 “Roughly half of the country is experiencing price gains,” explains Yun. “Multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed and forced property sales are virtually nonexistent.”2 The average national home price remains about 40% higher than it was in early 2020, according to the S&P CoreLogic Case-Shiller index.7 A tight housing supply has helped to buoy prices amidst a slowdown in sales. “While it varies from region to region, home prices at the national level may fall 1% or 1.5% by the end of the year, so not much,” Doug Duncan, senior vice president and chief economist at Fannie Mae, told Yahoo Finance in April.8 Record levels of home equity will help to stabilize the sector and prevent a wave of foreclosures, even as prices moderate, according to Mark Zandi, chief economist at Moody’s Analytics.9 “But for those who have owned a home for more than a year or two, their home will remain a rock-solid investment. And once affordability is restored, the next generation of households can become homeowners. Getting there is critical to the financial well-being of those households, their communities, and the broader economy,” writes Zandi in The Washington Post.9 What does it mean for you? Prices have softened in certain market segments—and motivated sellers are out there and willing to make deals. We can help you find your next home and negotiate a great price. If you’re a homeowner, the surge in home values has slowed, but you’re likely still sitting on a nice pile of equity. Reach out for a free assessment to find out how much your home is currently worth. LISTING INVENTORY IS LOW, BUT NEW CONSTRUCTION IS ON THE RISE Unsold existing home inventory rose 7.2% from March to April, according to NAR. At the current level of demand, this equates to 2.9 months of supply, which is still well below the 5 to 6 months of inventory required for a “balanced” market.2 Inventory remains tight despite the market slowdown because many would-be sellers are reluctant to give up their lower mortgage rates. “Affordability is not only an issue for first-time homebuyers, but also for many repeat buyers who still need to take on a mortgage,” explains Danielle Hale, chief economist for Realtor.com.10 In a recent survey by the home listing site, 82% of respondents who are planning to both buy and sell a home said they feel “locked in” by their low rate.11 In some areas, new home construction is helping to fill the supply gap. “Currently, one-third of housing inventory is new construction, compared to historical norms of a little more than 10%,” according to National Association of Home Builders Chief Economist Robert Dietz.12 And more new homes are in the pipeline, after a builder slowdown last year. Single-family housing starts rose 1.6% from March to April (seasonally adjusted) and new construction permits hit a seven-month high.13 What does it mean for you? Inventory remains tight, but less competition means more choice and negotiating power for buyers. If you’ve had trouble finding a home in the past, it may be time to take another look. We can help you explore both new and existing homes in our area. Sellers are enjoying reduced competition right now, as well. However, the longer you wait to list, the more competition you’re likely to face. And if you feel locked in by your current, lower mortgage rate, consider this: If you roll your equity gains into a down payment on your next home, you could possibly lower your monthly payment. Reach out to discuss your options. MORTGAGE RATES MAY FINALLY COME DOWN According to Freddie Mac, the average 30-year fixed-rate mortgage hit a peak of 7.08% in the fourth quarter of 2022, and since then it’s primarily floated between 6 and 7%.14 However, there are signs that rates could trend lower later this year. “Calmer inflation means lower mortgage rates, eventually,” Yun predicted in a recent statement. “Mortgage rates slipping down to under 6% looks very likely toward the year’s end.”15 Other leading economists agree. In its May forecast, Fannie Mae speculates that 30-year fixed mortgage rates will continue to decline, averaging 6.0% in Q4 2023 and 5.4% by Q4 2024.4 Meanwhile, the MBA predicts rates will fall even faster, averaging 5.6% by Q4 2023 and 4.8% by Q4 2024.3 On May 3, the Federal Reserve raised its benchmark borrowing rate by another quarter point—its 10th consecutive increase since March 2022. However, in its corresponding statement, the Fed omitted language from its previous release about “additional policy firming,” leaving many analysts to speculate that the rate hikes may be over.16 Although mortgage rates aren’t directly tied to the federal funds rate, a decision by the Fed to pause rate increases could have a positive effect. In the meantime, buyers should shop around multiple lenders to find the best rate—and buckle up for what could be an exciting ride. What does it mean for you? Mortgage rates may finally trend down, which would be great news for buyers. But, a decrease in rates could correspond with an increase in competition and prices. If you start searching now, you’ll be prepared to make an offer when the time is right. We can help you negotiate a great deal and potential seller incentives. If you’re planning to sell, this is good news for you, too. But, there are several factors to consider when determining the right time to list your home. Reach out for a consultation so we can help you chart the best course. WE’RE HERE TO GUIDE YOU While national real estate forecasts can provide a “big picture” outlook, real estate is local. And as local market experts, we can guide you through the ins and outs of our market and the issues most likely to impact sales and drive home values in your particular neighborhood. If you’re considering buying or selling a home, contact us now to schedule a free consultation. We’ll work with you to develop an action plan to meet your real estate goals. The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: National Association of Realtors -https://www.nar.realtor/newsroom/existing-home-sales-slid-2-4-in-march National Association of Realtors -https://www.nar.realtor/newsroom/existing-home-sales-faded-3-4-in-april Mortgage Bankers Association -https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-may-2023.pdf?sfvrsn=4bf1d1a7_1 Fannie Mae -https://www.fanniemae.com/media/47006/display U.S. Census Bureau -https://www.census.gov/construction/nrs/current/index.html National Association of Home Builders -https://www.nahb.org/news-and-economics/press-releases/2023/05/lack-of-existing-inventory--boosts-builder-confidence-to-key-marker New York Times -https://www.nytimes.com/2023/04/29/business/spring-housing-market.html? Yahoo Finance -https://finance.yahoo.com/news/mortgage-rates-increase-after-weeks-of-declines-160015631.html The Washington Post -https://www.washingtonpost.com/business/2023/04/22/housing-prices-put-some-out-of-the-market/ CNBC -https://www.cnbc.com/2023/04/20/home-sales-fell-in-march-amid-volatility-in-mortgage-rates.html Realtor.com -https://www.realtor.com/research/2023-q1-sellers-survey-btts/ National Association of Home Builders -https://www.nahb.org/news-and-economics/press-releases/2023/04/lack-of-existing-inventory-continues-to-support-builder-sentiment United State Census Bureau -https://www.census.gov/construction/nrc/pdf/newresconst.pdf Freddie Mac -https://www.freddiemac.com/pmms National Association of Realtors -https://www.nar.realtor/blogs/economists-outlook/instant-reaction-inflation-april-12-2023 CNBC -https://www.cnbc.com/2023/05/03/fed-rate-decision-may-2023-.html

Take Advantage of Your Home Equity: A Homeowner’s Guide

Homeownership offers many advantages over renting, including a stable living environment, predictable monthly payments, and the freedom to make modifications. Neighborhoods with high rates of homeownership have less crime and more civic engagement. Additionally, studies show that homeowners are happier and healthier than renters, and their children do better in school.1 But one of the biggest perks of homeownership is the opportunity to build wealth over time. Researchers at the Urban Institute found that homeownership is financially beneficial for most families,2 and a recent study showed that the median net worth of homeowners can be up to 80 times greater than that of renters in some areas.3 So how does purchasing a home help you build wealth? And what steps should you take to maximize the potential of your investment? Find out how to harness the power of home equity for a secure financial future. WHAT IS HOME EQUITY? Home equity is the difference between what your home is worth and the amount you owe on your mortgage. So, for example, if your home would currently sell for $850,000, and the remaining balance on your mortgage is $400,000, then you have $450,000 in home equity. $850,000 (Home’s Market Value) - $400,000 (Mortgage Balance) ______________________________ $450,000 (Home Equity) The equity in your home is considered a non-liquid asset. It’s your money; but rather than sitting in a bank account, it’s providing you with a place to live. And when you factor in the potential of appreciation, an investment in real estate will likely offer a better return than any savings account available today. HOW DOES HOME EQUITY BUILD WEALTH? A mortgage payment is a type of “forced savings” for home buyers. When you make a mortgage payment each month, a portion of the money goes towards interest on your loan, and the remaining part goes towards paying off your principal, or loan balance. That means the amount of money you owe the bank is reduced every month. As your loan balance goes down, your home equity goes up. Additionally, unlike other assets that you borrow money to purchase, the value of your home generally increases, or appreciates, over time. For example, when you pay off your car loan after five or seven years, you will own it outright. But if you try to sell it, the car will be worth much less than when you bought it. However, when you purchase a home, its value typically rises over time. So when you sell it, not only will you have grown your equity through your monthly mortgage payments, but in most cases, your home’s market value will be higher than what you originally paid. And even if you only put down 10% at the time of purchase—or pay off just a small portion of your mortgage—you get to keep 100% of the property’s appreciated value. That’s the wealth-building power of real estate.WHAT CAN I DO TO GROW MY HOME’S EQUITY FASTER? Now that you understand the benefits of building equity, you may wonder how you can speed up your rate of growth. There are two basic ways to increase the equity in your home: 1. Pay down your mortgage.We shared earlier that your home’s equity goes up as your mortgage balance goes down. So paying down your mortgage is one way to increase the equity in your home. Some homeowners do this by adding a little extra to their payment each month, making one additional mortgage payment per year, or making a lump-sum payment when extra money becomes available—like an annual bonus, gift, or inheritance. Before making any extra payments, however, be sure to check with your mortgage lender about the specific terms of your loan. Some mortgages have prepayment penalties. And it’s important to ensure that if you do make additional payments, the money will be applied to your loan principal. Another option to pay off your mortgage faster is to decrease your amortization period. For example, if you can afford the larger monthly payments, you might consider refinancing from a 30-year or 25-year mortgage to a 15-year mortgage. Not only will you grow your home equity faster, but you could also save a bundle in interest over the life of your loan.2. Raise your home’s market value. Boosting the market value of your property is another way to grow your home equity. While many factors that contribute to your property’s appreciation are out of your control (e.g. demographic trends or the strength of the economy) there are things you can do to increase what it’s worth. For example, many homeowners enjoy do-it-yourself projects that can add value at a relatively low cost. Others choose to invest in larger, strategic upgrades. Keep in mind, you won’t necessarily get back every dollar you invest in your home. In fact, according to Remodeling Magazine’s latest Cost vs. Value Report, the remodeling project with the highest return on investment is a garage door replacement, which costs about $3600 and is expected to recoup 97.5% at resale. In contrast, an upscale kitchen remodel—which can cost around $130,000—averages less than a 60% return on investment.4 Of course, keeping up with routine maintenance is the most important thing you can do to protect your property’s value. Neglecting to maintain your home’s structure and systems could have a negative impact on its value—therefore reducing your home equity. So be sure to stay on top of recommended maintenance and repairs. HOW DO I ACCESS MY HOME EQUITY IF I NEED IT? When you put your money into a checking or savings account, it’s easy to make a withdrawal when needed. However, tapping into your home equity is a little more complicated. The primary way homeowners access their equity is by selling their home. Many sellers will use their equity as a downpayment on a new home. Or some homeowners may choose to downsize and use the equity to supplement their income or retirement savings. But what if you want to access the equity in your home while you’re still living in it? Maybe you want to finance a home renovation, consolidate debt, or pay for college. To do that, you will need to take out a loan using your home equity as collateral. There are several ways to borrow against your home equity, depending on your needs and qualifications:5 Second Mortgage - A second mortgage, also known as a home equity loan, is structured similarly to a primary mortgage. You borrow a lump-sum amount, which you are responsible for paying back—with interest—over a set period of time. Most second mortgages have a fixed interest rate and provide the borrower with a predictable monthly payment. Keep in mind, if you take out a home equity loan, you will be making monthly payments on both your primary and secondary mortgages, so budget accordingly. Cash-Out Refinance - With a cash-out refinance, you refinance your primary mortgage for a higher amount than you currently owe. Then you pay off your original mortgage and keep the difference as cash. This option may be preferable to a second mortgage if you have a high-interest rate on your current mortgage or prefer to make just one payment per month. Home Equity Line of Credit (HELOC) - A home equity line of credit, or HELOC, is a revolving line of credit, similar to a credit card. It allows you to draw out money as you need it instead of taking out a lump sum all at once. A HELOC may come with a checkbook or debit card to enable easy access to funds. You will only need to make payments on the amount of money that has been drawn. Similar to a credit card, the interest rate on a HELOC is variable, so your payment each month could change depending on how much you borrow and how interest rates fluctuate. Reverse Mortgage - A reverse mortgage enables qualifying seniors to borrow against the equity in their home to supplement their retirement funds. In most cases, the loan (plus interest) doesn’t need to be repaid until the homeowners sell, move, or are deceased.6 Tapping into your home equity may be a good option for some homeowners, but it’s important to do your research first. In some cases, another type of loan or financing method may offer a lower interest rate or better terms to fit your needs. And it’s important to remember that defaulting on a home equity loan could result in foreclosure. Ask us for a referral to a lender or financial adviser to find out if a home equity loan is right for you. WE’RE HERE TO HELP YOU Wherever you are in the equity-growing process, we can help. We work with buyers to find the perfect home to begin their wealth-building journey. We also offer free assistance to existing homeowners who want to know their home’s current market value to refinance or secure a home equity loan. And when you’re ready to sell, we can help you get top dollar to maximize your equity stake. Contact us today to schedule a complimentary consultation! *The above references an opinion and is for informational purposes only. It is not intended to be financial advice. Consult a financial professional for advice regarding your individual needs. Sources: National Association of Realtors -https://www.nar.realtor/blogs/economists-outlook/highlights-from-social-benefits-of-homeownership-and-stable-housing Urban Institute - https://www.urban.org/urban-wire/homeownership-still-financially-better-renting Census Bureau -https://www.census.gov/library/stories/2019/08/gaps-in-wealth-americans-by-household-type.html Remodeling Magazine -https://www.remodeling.hw.net/cost-vs-value/2019/ Investopedia -https://www.investopedia.com/mortgage/heloc/home-equity/ Bankrate -https://www.bankrate.com/mortgage/reverse-mortgage-guide/

Categories

Recent Posts