Shut Down Home Intruders With These 7 Safety Strategies

According to the FBI, more than one million burglaries are committed in the United States each year, with victims suffering an estimated $3 billion in combined property losses.1 Fortunately, there are some proven tactics you can use to decrease your likelihood of a home invasion. Most burglars won’t go to extreme lengths to enter a residence. They are looking for easy access with minimal risk. A monitored security system can be an effective deterrent—homes without one are 300% more likely to be burglarized—but it isn’t the only way to protect your property.2 The strategies below can help to maximize your home’s security and minimize your chances of being targeted by intruders. Thinking about listing your home? We have some additional recommendations for you. Contact us to find out the procedures we use to keep our clients and their property safe and secure during the buying and selling process. 1. Check Your Doors and Windows According to home security company ADT, the most common entry point for a burglar is an unlocked front door (34%) followed by a first-floor window (23%) or back door (22%).3 So securing these points of entry is essential. Evaluate the condition of your doors and locks. A steel door is generally considered the strongest, but many homeowners prefer the look of wood. Whatever material you choose, make sure it has a solid core and pair it with a Grade 1 or 2 deadbolt lock with a reinforced strike plate.4 Add window locks and security film. Aftermarket window locks are an easy and inexpensive upgrade that can provide an additional layer of protection for your home. Choose a lock that is compatible with your window frame material and a style that is appropriate for the window type. And consider using a specialty film on windows that are adjacent to a door. Security film holds shattered glass in place, making the windows more difficult to penetrate.5 2. Landscape for Security When it comes to outdoor landscaping, many of us think about maintenance and curb appeal. But the choices we make can impact our home’s security, as well. Thieves target homes that they can enter and exit without being detected. Here are a few tweaks that can make your property less appealing to potential intruders. Increase visibility from the street. A privacy hedge may keep out nosy neighbors, but it can also welcome thieves—so trim overgrown trees and shrubs that obstruct the view of your property. According to police officers, they offer an ideal environment for criminals to hide.6 Place thorny bushes and noisy gravel below windows. Don’t eliminate shrubbery altogether, though. Certain hedges can actually offer a deterrent to robbers. Plant thorny rose bushes or sharp-leaved holly beneath your first-story windows for both beauty and protection. Add some loose gravel that crunches when disturbed. 3. Light Your Exterior When it’s dark outside, criminals don’t need to rely on overgrown shrubbery to hide. Luckily, a well-designed outdoor lighting system can make your home both safer and more attractive. Install landscape lighting. Eliminate pockets of darkness around your yard and home’s perimeter with strategically placed outdoor lights. Use a combination of flood, spot, well, and pathway lights to add interest and highlight natural and architectural details. Use motion-activated security lights to startle intruders. The soft glow of landscape lighting isn’t always enough to dissuade a determined intruder. But a motion-activated security light may stop him in his tracks. And if you choose a Wi-Fi connected smart version, you can receive notifications on your phone when there’s movement on your property. 4. Make It Look Like You’re Home Motion-activated lights aren’t the only way to make an intruder think you’re at home. New technology has made it increasingly possible to monitor your home while you’re away. This is especially important since most burglaries take place on weekdays between 10 am and 3 pm, when many of us are at work or school.2 Turn on your TV and leave a car in the driveway. A survey of convicted burglars revealed that the majority avoid breaking into homes if they can hear a television or if there’s a vehicle parked in the driveway.7 If you’re away from home, try connecting your TV to a timer or smart plug. And when you travel, leave your car out or ask a neighbor to park theirs in your driveway. Install a video doorbell. In that same survey, every respondent said they would knock or ring the doorbell before breaking into a home. A video doorbell not only alerts you to the presence of a visitor, it also enables you to see, hear, and talk with them remotely from your smartphone—so they’ll never know you’re gone. 5. Keep Valuables Out of Sight Few home invasions are conducted by criminal masterminds. In fact, a survey of convicted offenders found that only 12% planned their robberies in advance, while the majority acted spontaneously.8 That’s one of the reasons security experts caution against placing valuables where they are visible from the outside.9 Check sightlines from your doors and windows. Don’t tempt robbers with a clear view of the most commonly stolen items, which are cash (think purses and wallets), jewelry, electronics, firearms, and drugs (both illegal and prescription).6 Take a walk around your property to make sure none of these items are easily visible. Secure valuables in a safe. Consider the possessions that are on display inside your home, as well. It’s always a good idea to lock up firearms, sensitive documents, and expensive or irreplaceable items when you have housekeepers or other service providers on your property. 6. Highlight Your Security Measures While it’s prudent to hide your valuables, it’s equally important to advertise your home’s security features. In surveys, convicted burglars admit to avoiding homes with obvious protective measures in place.7,8 Install outdoor cameras. Security cameras are the most common home protection device and for good reason.10 Not only do they help prevent crime (burglars are known to avoid them), they can offer peace of mind for homeowners who want to sneak a peek at their property while away.11 And if you do experience a break-in, security camera footage can help police identify your intruder. Post warning signs. Security system placards and beware-of-dog signs are also shown to be effective deterrents.8 Of course, you should back up your threats with a noisy alarm and loud barking dog for maximum impact. 7. Limit What You Share on Social Media Social media platforms can be a great way to stay connected with friends and family, but it’s easy to reveal more than you’ve intended. Be thoughtful about what you’re posting—and who has access. Delay posting photos or travel updates. It can be tempting to upload a concert selfie or pictures from your beach vacation. But these types of photos scream: “My house is unoccupied!” Try to wait until you’ve returned home to share the photos on social media. Set privacy restrictions on your accounts. Think twice about connecting with strangers or casual acquaintances on social media. If you enjoy sharing family updates and personal photos, it’s safer to limit your followers to those you truly know and trust. YOUR HOME IS SAFE WITH US We take home security seriously. That’s why we have screening procedures in place to keep our clients and their homes safe when they are for sale. We also remind our buyers to change the locks before they move into their new homes and provide referrals to locksmiths and home security companies that can help. To learn more about our procedures and how you can stay safe during the buying and selling process, contact us to schedule a free consultation! Sources: Federal Bureau of Investigation -https://ucr.fbi.gov/crime-in-the-u.s/2019/crime-in-the-u.s.-2019/topic-pages/burglary Bankrate -https://www.bankrate.com/insurance/homeowners-insurance/house-burglary-statistics/ ADT -https://www.adt.com/resources/how-do-burglars-break-into-houses National Crime Prevention Council -https://www.ncpc.org/wp-content/uploads/2017/11/locking-your-home-reva-1-pdf.pdf SafeWise -https://www.safewise.com/blog/10-simple-ways-to-secure-your-new-home/ Forbes -https://www.forbes.com/sites/houzz/2014/03/20/how-your-landscaping-can-keep-burglars-away/?sh=2a8addf27429 KGW News -https://www.kgw.com/article/news/investigations/86-burglars-say-how-they-break-into-homes/283-344213396 Science Daily -https://www.sciencedaily.com/releases/2013/05/130516160916.htm org -https://www.security.org/home-security-systems/home-invasion-protection/ SafeWise -https://www.safewise.com/resources/security-stats-facts/ The Guardian -https://www.theguardian.com/business/2017/aug/18/former-burglars-barking-dogs-cctv-best-deterrent

5 Factors That Reveal Where The Real Estate Market Is Really Headed

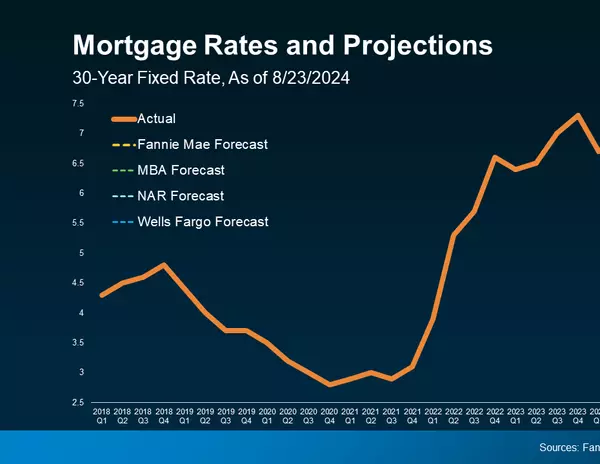

It’s the old supply-and-demand predicament: Home sales in the U.S. Real Estate Market continue at a torrid pace, but the availability of listings remains limited. Buoyed by historically low mortgage rates, buyers keep shopping for homes, reducing the available inventory and sparking a rise in home prices across the country. News website The Atlantic summarized the sizzling home market this way: “Pick a housing statistic at random, and it’s probably setting an all-time record. Home prices: record high. Inventory: record low. Percentage of homes selling above asking price: record high. Average time on market: record low.”¹ Meanwhile, homebuilders are contending with an increase in material costs and a shortage of labor. These issues come amid an ongoing shortage of housing. A study commissioned by the National Association of Realtors found the U.S. is coping with a deficit of about 2 million single-family homes and about 3.5 million other housing units.² So what can we expect from U.S. real estate? Here are five factors that illustrate where the housing market is today and is likely heading tomorrow. ROCK-BOTTOM MORTGAGE RATES TO GRADUALLY RISE Low interest rates continue to fuel demand from homebuyers. Some experts believe mortgage rates will creep up later this year, but they expect rates to remain near historic lows.3 However, the Federal Reserve signaled in mid-June that it may institute two interest rate hikes as soon as 2023, which could then trigger a more substantial uptick in mortgage rates.4 In June, the Mortgage Bankers Association reported that 2020 closed with the average rate for a 30-year, fixed-rate mortgage sitting at 2.8%. But the association anticipates the average rate climbing to 3.5% at the end of 2021 and 4.2% by the end of 2022.5 “As the economy progresses and inflation remains elevated, we expect that rates will continue to gradually rise in the second half of the year,” said Sam Khater, chief economist at Freddie Mac.6 What does it mean for you? You’ve likely heard the old saying about “striking while the iron is hot.” Well, that phrase applies to the current environment for mortgage rates. It’s impossible to predict with certainty when mortgage rates will rise or fall. So, when mortgage rates are at or near historic lows (as they are today), you should seriously consider taking advantage of those rates to borrow money for a home purchase or to refinance your existing mortgage. HOME PRICES EXPECTED TO KEEP CLIMBING Low mortgage rates are sparking interest among homebuyers, but some are running into affordability issues. In June, the national median list price for a home reached an all-time high of $385,000, up 12.7% on a year-over-year basis.7 And according to the Home Buying Institute, various reports and forecasts indicate home prices will keep climbing throughout 2021 and into 2022.8 While this may be welcome news for homeowners, high prices are pushing homeownership out of reach for a growing number of first-time buyers. In a recent CoreLogic survey, 82% of respondents listed housing affordability as a key problem.9 “Younger and first-time buyers, including younger millennials, are faced with the challenge of having sufficient savings for a down payment, closing costs and cash reserves,” said Frank Martell, President and CEO of CoreLogic. “As we look to the balance of 2021, we expect price rises to continue which could very well push prospective buyers out of the market in many areas and slow home price growth over the next year.”9 What does it mean for you? If you’re a buyer waiting on the sidelines for prices to drop, you may want to reconsider. While the pace of appreciation should taper off, home prices are expected to continue climbing. And rising mortgage rates will only make a home purchase more expensive. SINGLE-FAMILY HOME SALES REMAIN ROBUST While record-high prices are sidelining some buyers, the impressive pace of single-family home sales marches on. Single-family home sales are down from their peak in October 2020 yet are still above the overall level last year. In May 2021, 5.8 million existing single-family homes were sold in the U.S. That’s a 45% increase over the 4 million homes sold in May 2020.10 However, home sales saw a 0.9% dip in May 2021 compared with the previous month, the National Association of Realtors says. That was the fourth straight month for a decline in home sales. The number of home sales has slid recently because of rising prices coupled with a shortage of available homes amid intense demand.10 Fannie Mae expects total home sales to tick up slightly in the fourth quarter and finish the year up 3.8% over last year. They also forecast a slight decline of 2.2% in sales volume in 2022.11 What does it mean for you? The market for single-family home sales remains quite active. As a result, if you’re a homeowner, you may want to ponder whether to sell now, even if you hadn’t necessarily been thinking about doing so. With demand high and inventory low, your home could fetch an eye-popping price. LACK OF INVENTORY STILL CONSTRAINS THE HOME MARKET According to the National Association of Realtors, in May there were 1.23 million previously owned homes on the market, down 20.6% from the same time last year.10 This translates to a 2.5-month supply of homes, which is well below the 6 months of inventory typically seen in a balanced market.10,12 According to the Realtors group, this lack of inventory translates into tougher searches for buyers and contributes to a rise in prices.10 “Demand for bigger and more expensive accommodations amid the COVID-19 pandemic, which has left millions of Americans still working from home, is driving a housing market boom. The inventory of previously owned homes is near record lows,” according to Reuters.13 What does it mean for you? If you’re thinking of selling your home, now may be the right time to do it. Across the country, it’s a seller’s market, meaning demand is outpacing supply. That supply-and-demand imbalance puts sellers in a great position to sell their homes at a premium price. The May 2021 Realtors Confidence Index from the National Association of Realtors found the average home that was sold attracted five offers, and the association says nearly half of homes are selling above list price.14,15 CONSTRUCTION OF SINGLE-FAMILY HOMES SEES SLIGHT UPTICK Frustrated buyers may soon find some relief, however, from an increase in new construction. Economists forecast that 1.1 million new houses will be started in 2021, compared with a predicted 940,000 units just six months ago, with 1.2 million new starts predicted for 2022 and 2023, according to the Urban Land Institute.16 Amid the rise in home construction, builders are coping with rising costs for materials. In April, the National Association of Home Builders estimated that a surge in lumber prices over the previous year had led to $35,872 being tacked onto the cost of an average new single-family home.17 “Shortages of materials and labor have builders struggling to increase production of new homes, though the demand remains strong,” Robert Frick, corporate economist at Navy Federal Credit Union, told the Reuters news service. “Potential homebuyers should expect tight inventories and rising prices for both new and existing homes for the foreseeable future.”18 Builders (and buyers) did receive some good news in June, though: Lumber prices are coming down—although likely to remain above pre-pandemic levels for the foreseeable future.19 What does it mean for you? Given the issues affecting the new-home market, it may make sense to widen your home search to include both new and existing homes. Your brand-new dream home may not be available, but you might be able to find an existing home that lives up to your vision. Keep in mind that we can help you find either a new or existing home and can advocate for you to ensure you get the best deal possible. ARE YOU THINKING OF BUYING OR SELLING? If you’re in the market for a home, you’re ready to sell your house or you’ve simply been wondering whether you should sell, you definitely could benefit from an expert to help you navigate the sizzling hot real estate market. Let’s set up a free consultation to discuss your situation. We can help you figure out your options and come up with a plan to capitalize on the value of your current property or to find your ideal next home. Sources: The Atlantic -https://www.theatlantic.com/ideas/archive/2021/05/us-housing-market-records/619029/ Wall Street Journal - https://www.wsj.com/articles/u-s-housing-market-needs-5-5-million-more-units-says-new-report-11623835800 Time -https://time.com/nextadvisor/mortgages/mortgage-predictions-2021/ Bankrate -https://www.bankrate.com/banking/federal-reserve/fomc-meeting-recap-june-2021/ Mortgage Bankers Association - https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary/mortgage-finance-forecast-archives Associated Press News -https://apnews.com/press-release/globe-newswire/mortgages-mortgage-rates-business-0fc0360d0f4af0c988504385fa2794c3 Realtor.com -https://www.realtor.com/research/june-2021-data/ Home Buying Institute -http://www.homebuyinginstitute.com/news/home-prices-will-keep-rising-through-2021/ DS News -https://dsnews.com/daily-dose/07-06-2021/record-high-home-prices-intensify-affordability-challenges National Association of Realtors -https://www.nar.realtor/newsroom/existing-home-sales-experience-slight-skid-of-0-9-in-may Fannie Mae -https://www.fanniemae.com/media/40561/display Real Estate Center at Texas A&M University -https://assets.recenter.tamu.edu/documents/articles/2046-7.pdf Reuters -https://www.reuters.com/world/us/us-housing-starts-rise-less-than-expected-may-building-permits-fall-2021-06-16/ National Association of Realtors - https://www.nar.realtor/research-and-statistics/research-reports/realtors-confidence-index Realtor magazine -https://magazine.realtor/daily-news/2021/05/17/report-half-of-homes-sell-above-list-price

Can I Buy or Sell a Home Without a Real Estate Agent?

Today’s real estate market is one of the fastest-moving in recent memory. With record-low inventory in many market segments, we’re seeing multiple offers—and sometimes even bidding wars—for homes in the most sought-after neighborhoods. This has led some sellers to question the need for an agent. After all, why spend money on a listing agent when it seems that you can stick a For Sale sign in the yard then watch a line form around the block? Some buyers may also believe they’d be better off purchasing a property without an agent. For those seeking a competitive edge, proceeding without a buyer’s agent may seem like a good way to stand out from the competition—and maybe even score a discount. Since the seller pays the buyer agent’s commission, wouldn’t a do-it-yourself purchase sweeten the offer? We all like to save money. However, when it comes to your largest financial asset, forgoing professional representation may not always be in your best interest. Find out whether the benefits outweigh the risks (and considerable time and effort) of selling or buying a home on your own—so you can head to the closing table with confidence. SELLING YOUR HOME WITHOUT A REAL ESTATE AGENT Most homeowners who choose to sell their home without any professional assistance opt for a traditional “For Sale By Owner” or a direct sale to an investor, such as an iBuyer. Here’s what you can expect from either of these options. For Sale By Owner (FSBO) For sale by owner or FSBO (pronounced fizz-bo) offers sellers the opportunity to price their own home and handle their own transaction, showing the home and negotiating directly with the buyer or his or her real estate agent. According to data compiled by the National Association of Realtors, approximately 8% of homes are sold by their owner.1 In an active, low inventory real estate market, it may seem like a no-brainer to sell your home yourself. After all, there are plenty of buyers out there and one of them is bound to be interested in your home. In addition, you’ll save money on the listing agent’s commission and have more control over the way the home is priced and marketed. One of the biggest problems FSBOs run into, however, is pricing the home appropriately. Without access to information about the comparable properties in your area, you could end up overpricing your home (causing it to languish on the market) or underpricing your home (leaving thousands of dollars on the table).2 Even during last year’s strong seller’s market, the median sales price for FSBOs was 10% less than the median price of homes sold with the help of a real estate agent.1 And during a more balanced market, like the one we experienced in 2018, FSBO homes sold for 24% (or $60,000) less than agent-represented properties.3 This suggests that, while you may think that you’ll price and market your home more effectively yourself, in fact you may end up losing far more than the amount you would pay for an agent’s assistance. Without the services of a real estate professional, it will be up to you to get people in the door. You’ll need to gather information for the online listing and put together the kind of marketing that today’s buyers expect to see. This includes bringing in a professional photographer, writing the listing description, and designing marketing collateral like flyers and mailers—or hiring a writer and graphic designer to do so. Once someone is interested, you’ll need to offer virtual showings and develop a COVID safety protocol. You’ll then need to schedule an in-person showing (or in some cases, two or three) for each potential buyer. In addition, you’ll be on your own when evaluating offers and determining their financial viability. You’ll need to thoroughly understand all legal contracts and contingencies and discuss terms, including those regarding the home inspection and closing process. While you’re doing all of this work, it’s likely that you’ll still need to pay the buyer agent’s commission. So be sure to weigh your potential savings against the significant risk and effort involved. If you choose to work with a listing agent, you’ll save significant time and effort while minimizing your personal risk and liability. And the increased profits realized through a more effective marketing and negotiation strategy could more than make up for the cost of your agent’s commission. iBuyer iBuyers have been on the scene since around 2015, providing sellers the option of a direct purchase from a real estate investment company rather than a traditional direct-to-consumer sales process.4 iBuyer companies tout their convenience and speed, with a reliable, streamlined process that may be attractive to some sellers. The idea is that instead of listing the home on the open market, the homeowner completes an online form with information about the property’s location and features, then waits for an offer from the company. The iBuyer is looking for a home in good condition that’s located in a good neighborhood—one that’s easy to flip and falls within the company’s algorithm. For sellers who are more focused on speed and convenience, an iBuyer may offer an attractive alternative to a traditional real estate sale. That’s because iBuyers evaluate a property quickly and make an upfront offer without requesting repairs or other accommodations. However, sellers will pay for that convenience with, generally, a far lower sale price than the market will provide as well as fees that can add up to as much or more than a traditional real estate agent’s commission. According to a study conducted by MarketWatch, iBuyers netted, on average, 11% less than a traditional sale when both the lower price and fees are considered.5 Other studies found some iBuyers charging as much as 15% in fees and associated costs, far more than you’ll pay for a real estate agent’s commission.6 In a hot market, this can mean leaving tens of thousands of dollars on the table since you won’t be able to negotiate and you’ll lose out on rising home prices caused by low inventory and increased demand. In addition, iBuyers are demonstrably less reliable during times of economic uncertainty, as evidenced by the halt of operations for most iBuyer platforms in early 2020.6 As a seller, the last thing you want is to start down the road of iBuying only to find out that a corporate mandate is stopping your transaction in its tracks. If you choose to work with a real estate agent, you can still explore iBuyers as an option. That way you can take advantage of the added convenience of a fast sale while still enjoying the protection and security of having a professional negotiating on your behalf. BUYING YOUR HOME WITHOUT AN AGENT According to the most recent statistics, 88% of home buyers use a real estate agent when conducting their home search.1 A buyer’s agent is with you every step of the way through the home buying process. From finding the perfect home to submitting a winning offer to navigating the inspection and closing processes, most homebuyers find their expertise and guidance invaluable. And the best part is that, because they are compensated through a commission paid by the homeowner at closing, most agents provide these services at no cost to you! Still, you may be considering negotiating your home purchase directly with the seller or listing agent, especially if you are accustomed to deal-making as part of your job. And if you are familiar with the neighborhood where you are searching, you may feel that there is no reason to get a buyer’s agent involved. However, putting together a winning offer package can be challenging. This is especially true in a multiple-offer situation where you’ll be competing against buyers whose offers are carefully crafted to maximize their appeal. And the homebuying process can get emotional. A trusted agent can help you avoid overpaying for a property or glossing over “red flags” in your inspection. In addition, buyer agents offer a streamlined, professional process that listing agents may be more likely to recommend to their clients. If you decide to forego an agent, you’ll have to write, submit, and negotiate a competitive offer all on your own. You’ll also need to schedule an inspection and negotiate repairs. You’ll be responsible for reviewing and preparing all necessary documents, and you will need to be in constant communication with the seller’s agent and your lender, inspector, appraiser, title company, and other related parties along the way. Or, you could choose to work with a buyer’s agent whose commission is paid by the seller and costs you nothing out of pocket. In exchange, you’ll obtain fiduciary-level guidance on one of the most important financial transactions of your life. If you decide to go it alone, you’ll be playing fast and loose with what is, for most people, their most important and consequential financial decision. SO, IS A REAL ESTATE AGENT RIGHT FOR YOU? It is important for you to understand your options and think through your preferences when considering whether or not to work with a real estate professional. If you are experienced in real estate transactions and legal contracts, comfortable negotiating under high-stakes circumstances, and have plenty of extra time on your hands, you may find that an iBuyer or FSBO sale works for you. However, if, like most people, you value expert guidance and would like an experienced professional to manage the process, you will probably experience far more peace of mind and security in working with a real estate agent or broker. A real estate agent’s comprehensive suite of services and expert negotiation skills can benefit buyers and sellers financially, as well. On average, sellers who utilize an agent walk away with more money than those who choose the FSBO or iBuyer route.3,5 And buyers pay nothing out of pocket for expert representation that can help them avoid expensive mistakes all along the way from contract to closing. According to NAR’s profile, the vast majority of buyers (91%) and sellers (89%) are thrilled with their real estate professional’s representation and would recommend them to others.1 That’s why, in terms of time, money, and expertise, most buyers and sellers find the assistance of a real estate agent essential and invaluable. QUESTIONS ABOUT BUYING OR SELLING? WE HAVE ANSWERS The best way to find out whether you need a real estate agent or broker is to speak with one. We’re here to help and to offer the insights you need to make better-informed decisions. Let’s talk about the value-added services we provide when we help you buy or sell in today’s competitive real estate landscape. Sources: National Association of REALTORS -https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers Washington Post -https://www.washingtonpost.com/business/2020/12/09/factors-consider-when-determining-whether-use-an-agent-buy-or-sell-home/ National Association of REALTORS -https://www.nar.realtor/blogs/economists-outlook/selling-your-home-solo-to-save-money-you-ll-actually-make-less-than-you-think Seattle Times -https://www.seattletimes.com/business/real-estate/redfin-is-first-major-ibuyer-to-sell-in-seattle MarketWatch -https://www.marketwatch.com/story/selling-your-home-to-an-ibuyer-could-cost-you-thousands-heres-why-2019-06-11 Forbes -https://www.forbes.com/sites/nataliakarayaneva/2020/03/19/billion-dollar-real-estate-businesses-ibuyer-suspended/?sh=c7f59f921747

Categories

Recent Posts