Renovate or Relocate? 3 Questions to Help You Decide

Does your current home no longer serve your needs? If so, you may be torn between relocating to a new home or renovating your existing one. This can be a difficult choice, and there’s a lot to consider—including potential costs, long-term financial implications, and quality of life. A major remodel can be a major commitment. From hiring contractors to selecting materials to managing a budget, it can take a tremendous amount of time and energy—not to mention the ordeal of living through construction or relocating to a temporary residence. On the other hand, moving is notoriously taxing. In fact, in one survey, 40% of respondents viewed buying a new home as ”the most stressful event in modern life.”1 So which is the better option for you? Let’s take a closer look at some of the factors you should consider before you decide. 1. What Are Your Motivations for Making a Change? It’s possible that some of the limitations of your current home can be addressed with a renovation, but others may require a move. Renovate Certain issues, like dated kitchens and bathrooms, are fairly easy to remedy with a remodel—and the results can be dramatic. In many cases, a relatively minor renovation can significantly increase your enjoyment of your home. Other shortcomings can be more challenging to fix but are worth exploring so that you know your options. For example, if your home feels cramped or it lacks certain rooms, you might be able to make changes like installing an extra bathroom, adding a dedicated office, or finishing an attic or basement. You may even be able to build an accessory dwelling unit or extension to accommodate a multi-generational family. In fact, many Americans have remodeled their homes to meet changing needs since the start of the pandemic. According to the National Association of the Remodeling Industry, 90% of their members reported increased demand for renovations starting in 2020, and 60% reported that the scale of remodeling projects has grown.2 However, the feasibility and cost of these larger changes will depend on factors ranging from zoning and permitting to your home’s current layout. Speaking with an architect or a contractor can help you make an informed decision. Let us refer you to one of our trusted partners to ensure you receive the best possible service. Relocate Of course, sometimes, even rebuilding your home from the ground up wouldn’t solve the problem. For example, moving may be the only solution if you’ve switched jobs and now face a lengthy commute or if you need to live closer to an aging family member. Conversely, if the shift to remote work has opened up your location options, you may wish to seize the opportunity to relocate to a new locale. A 2022 study found that nearly five million Americans had already moved since the start of the COVID-19 pandemic due to increased flexibility from remote work, and nearly 19 million more were planning to move in the near future for the same reasons.3 Moving may also be the best option, even when you’re happy with your geographic location. A local move may make sense if you’re looking for a larger backyard or significantly more space. Similarly, some frustrations—like living on a busy street or a long way from a grocery store—can’t be addressed with a renovation. We are well-versed in this area and can help you determine whether another neighborhood might suit you and your family better. 2. Which Option Makes the Most Financial Sense? Renovating and relocating both come with costs, and it’s wise to explore the financial implications of each choice before you move forward. Renovate The costs of a renovation can vary widely, so it’s vital to get several estimates from contractors upfront to understand what it might take to achieve your dream home. Be sure to consider all of the potential expenditures, from materials and permits to updates to your electrical and plumbing systems. It’s also prudent to add 10-20% to your total budget to account for unexpected issues.4 If you plan to DIY all or part of your renovation, don’t forget to factor in the value of your time. Renovations can also come with hidden expenses. These might include: Additional home insurance Short-term rental or hotel if you need to move out during the renovation Storage unit for possessions that need to be out of the way Dining out, laundry service, and other essentials if you can’t access appliances at home Remodeling choices can also impact the long-term value of your home. Some projects may increase your home’s value enough to outweigh your investment, while others could actually hurt your home’s resale potential. For example, although you may enjoy the additional living space, garage conversions aren’t typically popular with buyers.5 Refinishing hardwood floors, on the other hand, brings an average return of 147% at resale.2 The specific impact of a renovation will depend on a number of factors, including the quality of work, choice of materials, and buyer preferences in your area. We can help you assess how a planned project is likely to affect the value of your home. Relocate The cost of a new home, of course, will vary significantly depending on the features you’re seeking. However, you may find that it’s cheaper to move to a home that has everything you want than it is to make major changes to your existing one. For example, adding a downstairs bedroom suite or opening up a closed floor plan could cost you more than it would to buy a home that already has those features. On the other hand, simpler changes and updates probably won’t outweigh the expense of a relocation. If you’re considering a move, speak with a real estate agent early in the process. We can assess your current home’s value and estimate the price of a new home that meets your needs. This will help you set an appropriate budget and expectations. It’s important to remember that the cost of buying a new home doesn't end with the purchase price. You’ll also need to account for additional expenditures, including closing and moving costs and the fees involved with selling your current home. And don’t forget to compare current mortgage rates to your existing one to understand how a different rate could impact your monthly payment. However, keep in mind that the interest rate on a mortgage is typically lower than the rate on other loan types—so you could pay less interest on a new home purchase than you would on remodel.6 We’re happy to refer you to a lending professional who can help you explore your financing options. 3. Which Option Will Be the Least Disruptive to Your Life? A final—but critical—consideration is the time and hassle involved with each option since both renovating and relocating involve a significant amount of each. Renovate Don’t underestimate the time and effort involved in a large-scale renovation, even if you choose to hire a general contractor. You will still need to consider and make a number of decisions. For example, even a fairly basic kitchen remodel can involve a seemingly-endless selection of cabinets, tile, countertops, paint colors, fixtures, hardware, and appliances. And don’t assume that you will get out of packing and unpacking if you stay in your current home. Most renovations—from kitchens to bathrooms to flooring replacement—require you to remove your belongings during the construction process. The time frame for a remodel is another consideration. High demand for contractors and ongoing material shortages can mean a long wait to get started. And once the project is in progress, you can expect that it will take a couple of weeks to several months to complete.7 Contemplate whether you will be able to live in your home while it’s being renovated and how that would impact your routine. For example, being without a functional kitchen for months can be frustrating, inconvenient, and expensive (since you’ll need to purchase prepared food). Remember that delays are inevitable with construction, and consider what additional challenges they could present. Relocate Of course, finding a new home and selling your current one also takes a significant amount of time and energy. According to the National Association of Realtors’ 2022 Profile of Home Buyers and Sellers, the average buyer searched for 10 weeks and toured a median of five homes.8 However, in many cases, the timeline can still be shorter than a major renovation. Once you find a home that works for you, it typically takes between 30 and 60 days to close if you’re taking on a mortgage—and the process is even faster if you’re paying with cash.9 Plus, you can look for your dream home without the inconvenience of living in a construction zone. However, a move comes with its own stress and disruptions. If you’re selling your current home, you’ll need to prep it for the market and keep it ready and available for showings. Once you’ve found a place, the packing and moving process takes time and work, as does settling into a new home—especially if it’s in a different neighborhood. Fortunately, we are here to help make the moving process as easy as possible, if you choose to pursue that route. We can help you find a property that meets all your needs, sell your current one for top dollar, and refer you to some excellent moving companies that can help pack and transport your belongings. WHATEVER YOU DECIDE, WE CAN HELP The decision to renovate or relocate can be overwhelming—but this choice also presents a powerful opportunity to improve your quality of life. There’s a lot to consider, from how renovations could impact your home’s resale value down the road to your neighborhood’s current market dynamics. We’re happy to help you think through your options. Get in touch for a free consultation! *The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: HousingWire -https://www.housingwire.com/articles/46384-americans-say-buying-a-home-is-most-stressful-event-in-modern-life/ National Association of the Remodeling Industry -https://cdn.nar.realtor//sites/default/files/documents/2022-remodeling-impact-report-04-19-2022.pdf?_gl=1*3pfs0m*_gcl_au*NTU2MDQ0MzAyLjE2ODMyMzgzMTY Business Insider -https://www.businessinsider.com/5-million-people-moved-because-of-remote-work-since-2020-2022-3 Forbes -https://www.forbes.com/home-improvement/contractor/home-renovation-costs/ U.S. News & World Report -https://realestate.usnews.com/real-estate/articles/10-home-renovations-that-can-decrease-the-value-of-your-home Bankrate -https://www.bankrate.com/mortgages/mortgage-vs-home-equity-loan/#differences House Beautiful -https://www.housebeautiful.com/home-remodeling/a25588459/home-renovation-timeline/ National Association of Realtors -https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers Forbes -https://www.forbes.com/advisor/mortgages/how-long-does-it-take-to-close-on-a-house/

National Real Estate Market Update for 2023

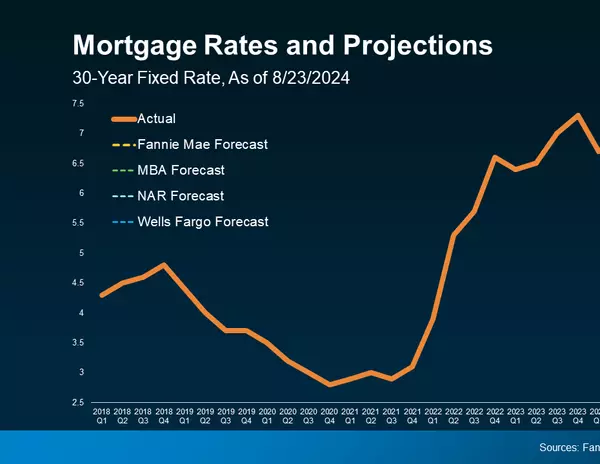

There’s an old adage in real estate: location, location, location. But ever since the Federal Reserve began its series of inflation-fighting interest rate hikes last year, a new mantra has emerged: mortgage rates, mortgage rates, mortgage rates. Higher rates had the immediate impact of dampening homebuyer affordability and demand. But this year, we’re seeing further repercussions. While analysts expected listing inventory to swell as sales declined, instead, homeowners have been pushing off plans to sell because they feel beholden to their existing, lower mortgage rates. So what impact is this reduced demand and low supply environment having on home values? And what can we expect from the real estate market in the coming months and years? Here are several key indicators that help to paint a picture of the current market and where it’s likely headed. HOME SALES ARE EXPECTED TO PICK UP BY EARLY NEXT YEAR The weather isn’t the only thing that heats up in the spring and summer. Nationally, it tends to be the busiest time in real estate. But this year, the peak season got off to a slow start, with sales declines in both March and April.1,2 Existing home sales in April were down 3.4% from the previous month—and 23.2% from a year earlier.2 What’s causing this market slowdown? Industry experts attribute it to several factors, including near-record home prices, high mortgage rates, and low inventory. According to National Association of Realtors (NAR) Chief Economist Lawrence Yun, “Home sales are trying to recover and are highly sensitive to changes in mortgage rates. Yet, at the same time, multiple offers on starter homes are quite common, implying more supply is needed to fully satisfy demand. It's a unique housing market.”1 However, some industry experts believe the market is poised for a comeback. Forecasters at the Mortgage Bankers Association (MBA) predict that home sales will continue to fall through Q3 before rising in Q4 and throughout next year.3 Analysts at Fannie Mae expect the recovery to take a bit longer, picking up in early 2024. Meanwhile, home builder confidence is already up, as purchases of new single-family homes surged in March and April to a 13-month high.5 Builder incentives are helping to boost sales: According to the National Association of Home Builders, in May, 54% reported using them to win over budget-conscious buyers.6 What does it mean for you? A slower pace of sales has given buyers some breathing room. If you hated the frenzy of the pandemic-era real estate market, now might be a better time for you to shop for a home. We can help you evaluate your options and make an informed purchase. If you plan to sell your home, prepare yourself for less foot traffic and a longer sales timeline than you may have found a year ago. It will also be crucial to enlist the help of a skilled agent who knows how to draw in buyers. Reach out for a copy of our multi-step Property Marketing Plan. PROPERTY VALUES REMAIN RELATIVELY STABLE Some good news for buyers: While home builder sales climbed in April, the median new-house price fell to $420,800, an 8.2% decrease from a year ago.5 Meanwhile, the median existing-home price dropped to $388,800, down 1.7% year-over-year. Notably, existing-home prices rose in parts of the country but fell in the South and West.2 “Roughly half of the country is experiencing price gains,” explains Yun. “Multiple-offer situations have returned in the spring buying season following the calmer winter market. Distressed and forced property sales are virtually nonexistent.”2 The average national home price remains about 40% higher than it was in early 2020, according to the S&P CoreLogic Case-Shiller index.7 A tight housing supply has helped to buoy prices amidst a slowdown in sales. “While it varies from region to region, home prices at the national level may fall 1% or 1.5% by the end of the year, so not much,” Doug Duncan, senior vice president and chief economist at Fannie Mae, told Yahoo Finance in April.8 Record levels of home equity will help to stabilize the sector and prevent a wave of foreclosures, even as prices moderate, according to Mark Zandi, chief economist at Moody’s Analytics.9 “But for those who have owned a home for more than a year or two, their home will remain a rock-solid investment. And once affordability is restored, the next generation of households can become homeowners. Getting there is critical to the financial well-being of those households, their communities, and the broader economy,” writes Zandi in The Washington Post.9 What does it mean for you? Prices have softened in certain market segments—and motivated sellers are out there and willing to make deals. We can help you find your next home and negotiate a great price. If you’re a homeowner, the surge in home values has slowed, but you’re likely still sitting on a nice pile of equity. Reach out for a free assessment to find out how much your home is currently worth. LISTING INVENTORY IS LOW, BUT NEW CONSTRUCTION IS ON THE RISE Unsold existing home inventory rose 7.2% from March to April, according to NAR. At the current level of demand, this equates to 2.9 months of supply, which is still well below the 5 to 6 months of inventory required for a “balanced” market.2 Inventory remains tight despite the market slowdown because many would-be sellers are reluctant to give up their lower mortgage rates. “Affordability is not only an issue for first-time homebuyers, but also for many repeat buyers who still need to take on a mortgage,” explains Danielle Hale, chief economist for Realtor.com.10 In a recent survey by the home listing site, 82% of respondents who are planning to both buy and sell a home said they feel “locked in” by their low rate.11 In some areas, new home construction is helping to fill the supply gap. “Currently, one-third of housing inventory is new construction, compared to historical norms of a little more than 10%,” according to National Association of Home Builders Chief Economist Robert Dietz.12 And more new homes are in the pipeline, after a builder slowdown last year. Single-family housing starts rose 1.6% from March to April (seasonally adjusted) and new construction permits hit a seven-month high.13 What does it mean for you? Inventory remains tight, but less competition means more choice and negotiating power for buyers. If you’ve had trouble finding a home in the past, it may be time to take another look. We can help you explore both new and existing homes in our area. Sellers are enjoying reduced competition right now, as well. However, the longer you wait to list, the more competition you’re likely to face. And if you feel locked in by your current, lower mortgage rate, consider this: If you roll your equity gains into a down payment on your next home, you could possibly lower your monthly payment. Reach out to discuss your options. MORTGAGE RATES MAY FINALLY COME DOWN According to Freddie Mac, the average 30-year fixed-rate mortgage hit a peak of 7.08% in the fourth quarter of 2022, and since then it’s primarily floated between 6 and 7%.14 However, there are signs that rates could trend lower later this year. “Calmer inflation means lower mortgage rates, eventually,” Yun predicted in a recent statement. “Mortgage rates slipping down to under 6% looks very likely toward the year’s end.”15 Other leading economists agree. In its May forecast, Fannie Mae speculates that 30-year fixed mortgage rates will continue to decline, averaging 6.0% in Q4 2023 and 5.4% by Q4 2024.4 Meanwhile, the MBA predicts rates will fall even faster, averaging 5.6% by Q4 2023 and 4.8% by Q4 2024.3 On May 3, the Federal Reserve raised its benchmark borrowing rate by another quarter point—its 10th consecutive increase since March 2022. However, in its corresponding statement, the Fed omitted language from its previous release about “additional policy firming,” leaving many analysts to speculate that the rate hikes may be over.16 Although mortgage rates aren’t directly tied to the federal funds rate, a decision by the Fed to pause rate increases could have a positive effect. In the meantime, buyers should shop around multiple lenders to find the best rate—and buckle up for what could be an exciting ride. What does it mean for you? Mortgage rates may finally trend down, which would be great news for buyers. But, a decrease in rates could correspond with an increase in competition and prices. If you start searching now, you’ll be prepared to make an offer when the time is right. We can help you negotiate a great deal and potential seller incentives. If you’re planning to sell, this is good news for you, too. But, there are several factors to consider when determining the right time to list your home. Reach out for a consultation so we can help you chart the best course. WE’RE HERE TO GUIDE YOU While national real estate forecasts can provide a “big picture” outlook, real estate is local. And as local market experts, we can guide you through the ins and outs of our market and the issues most likely to impact sales and drive home values in your particular neighborhood. If you’re considering buying or selling a home, contact us now to schedule a free consultation. We’ll work with you to develop an action plan to meet your real estate goals. The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: National Association of Realtors -https://www.nar.realtor/newsroom/existing-home-sales-slid-2-4-in-march National Association of Realtors -https://www.nar.realtor/newsroom/existing-home-sales-faded-3-4-in-april Mortgage Bankers Association -https://www.mba.org/docs/default-source/research-and-forecasts/forecasts/2023/mortgage-finance-forecast-may-2023.pdf?sfvrsn=4bf1d1a7_1 Fannie Mae -https://www.fanniemae.com/media/47006/display U.S. Census Bureau -https://www.census.gov/construction/nrs/current/index.html National Association of Home Builders -https://www.nahb.org/news-and-economics/press-releases/2023/05/lack-of-existing-inventory--boosts-builder-confidence-to-key-marker New York Times -https://www.nytimes.com/2023/04/29/business/spring-housing-market.html? Yahoo Finance -https://finance.yahoo.com/news/mortgage-rates-increase-after-weeks-of-declines-160015631.html The Washington Post -https://www.washingtonpost.com/business/2023/04/22/housing-prices-put-some-out-of-the-market/ CNBC -https://www.cnbc.com/2023/04/20/home-sales-fell-in-march-amid-volatility-in-mortgage-rates.html Realtor.com -https://www.realtor.com/research/2023-q1-sellers-survey-btts/ National Association of Home Builders -https://www.nahb.org/news-and-economics/press-releases/2023/04/lack-of-existing-inventory-continues-to-support-builder-sentiment United State Census Bureau -https://www.census.gov/construction/nrc/pdf/newresconst.pdf Freddie Mac -https://www.freddiemac.com/pmms National Association of Realtors -https://www.nar.realtor/blogs/economists-outlook/instant-reaction-inflation-april-12-2023 CNBC -https://www.cnbc.com/2023/05/03/fed-rate-decision-may-2023-.html

How to Become a Homeowner on a First-Time Buyer’s Budget

It's not easy being a first-time homebuyer right now. At the end of last year, housing affordability hit an all-time low.1 Additionally, mortgage rates have risen significantly since 2021, while inventory remains tight for many property categories, but especially for starter homes. Even lower-priced condos are harder to snag these days, as investors and downsizers muscle out first-timers by offering stronger, often cash-heavy bids.2 In fact, according to the National Association of Realtors, only 26% of last year's homebuyers were first-timers—the lowest share on record and down from 34% a year prior. This underscores just how steep a hill new buyers are facing.3 As a result, many first-time homebuyers are finding that they need to get creative or risk renting for longer than they planned. If you, too, are struggling to afford homeownership, here are some workarounds to consider as you plot your first home purchase. Try House Hacking “House hacking” is a real estate investment strategy in which participants use their homes to generate income in order to offset their expenditures. For example, renting out a basement apartment or accessory dwelling unit (ADU)—such as a detached garage that's been outfitted with a bathroom and small kitchen—counts as house hacking. So does splitting housing costs with a roommate or converting a part of your home into an Airbnb. House hacking isn’t new. But, it’s grown in popularity as a new crop of digital platforms has entered the market and made it easier than ever for homeowners to generate income from their property. In some cases, house hacking may make it possible for you to qualify for and afford your first home. A lender, for example, may approve you for a larger mortgage if you purchase a home with immediate income potential, such as a legal duplex or a property with a secondary suite that has a kitchen and full bathroom.4 In addition, house hacking could help you pay your mortgage once you move in. Here are just a few of the ways you could use your home to earn some extra cash: Offer paid parking in your driveway on a site like Spacer or SpotHero. Rent out your swimming pool for a few hours on Swimply. Make your home available for photoshoots or events on Giggster or Peerspace. Turn your backyard into a pay-by-the-hour dog park on Sniffspot. List your garage space on an app like Neighbor Storage. But before you make plans to house hack, make sure you fully understand an area's laws and HOA rules. We can help you find a home with income potential in a neighborhood with less restrictive zoning and regulations. Team Up With Friends or Family If you aren't wild about the idea of welcoming strangers to your home, you may want to consider co-purchasing with a friend or family member instead. This unconventional housing arrangement is also growing more popular as friends and family members cope with higher living costs by pooling resources. According to the National Association of Realtors' 2022 Profile of Home Buyers and Sellers, the share of first-time homebuyers living with people other than children or a romantic partner is currently at an all-time high.3 Meanwhile, research from Pew found that multigenerational living has accelerated especially quickly, with a quarter of U.S. adults aged 25 to 34 now living in a multigenerational home.5 Arrangements can be customized to fit your circumstances. For example, you could purchase a home and then rent a portion of it to a loved one. Or you might consider co-buying a home with friends or family members so that you can step onto the property ladder and start building equity together. Co-ownership could work out especially well for you long-term if it helps you to buy a home that's bigger, has more investment potential, or is located in a high-demand area and so appreciates at a faster rate. Plus, you'll get to see your loved ones more often and enjoy the coziness of shared living with people you like having around. On the other hand, sharing a big financial responsibility, like a mortgage, with friends or family could get messy—especially if you don't create a clear-cut co-ownership agreement beforehand that outlines your mutual expectations. So plan carefully before you proceed. In addition, you may need to rethink the type of home you pursue. For example, a smaller home might be cheaper, but do you really want that much togetherness all the time? We can help you set priorities and search for a suitable property. Tap Your Network for Help With Funding Another established method for affording a first home is to lean on family or friends for financial help. Getting assistance with the down payment or other borrowing costs can go a long way toward making your homeownership dreams come true. As long as you don't mind asking for help, a free-and-clear gift that's intended for your down payment is an ideal arrangement, since it will allow you to borrow less overall. Or, if that’s too big an ask, your loved ones could pitch in toward closing or moving costs. Alternatively, your loved ones could help by co-signing your loan. For example, if their credit score is a lot higher than yours, it could enable you to secure a lower interest rate so that your monthly payment is more affordable. According to a recent YouGov poll, more than a third of homeowners (and a whopping 79% of those under 30) received financial help from their parents when buying their first home.6 So you wouldn't be the only one leaning on family to help afford a home at today's prices. Just be sure your parents or other generous loved ones are aware they're giving a gift, not a loan, and are willing to put that in writing. A lender will want proof that this money isn't adding to your debt burden and may require documentation from your benefactors. Another way to tap your network for help is to crowdfund part of your down payment or ask for monetary gifts instead of tangible ones. For example, if you're getting married soon, you could skip the wedding gift registry and ask guests to contribute funds to your hoped-for home purchase instead. Look for Special Programs and Assistance You could also cut some of your upfront mortgage costs by applying for special grants and funding opportunities. For example, consider using a grant to help you fund your down payment. There are a number of public and private grants and down payment assistance programs that are expressly intended to help first-time buyers. Just like a gift, you don't have to pay a grant back. But, depending on your personal situation, you may find some grants difficult to qualify for—especially if you make a relatively high income. Many grants are reserved for lower-income buyers only.7 Check out grant programs, such as the HomePath Ready Buyer Program, National Homebuyers Fund, the Good Neighbor Next Door Program, and specialized grants from banks. Also look to state and local sources for potential grants and down payment assistance programs, including forgivable and deferred payment loans, Individual Development Accounts, and DPA Second Mortgages.7 Similarly, if you have enough income to support a house payment but can't spare much cash for your down payment, you may qualify for a government-sponsored loan, such as an FHA loan that allows you to put down as little as 3.5% to 10%.8 We can connect you with a lender or mortgage broker who can educate you about your options and help shepherd you through the process. Some financial assistance programs require you to work with specific lenders, while others require you to apply directly and fill out a separate application. In addition, you may look to even less conventional options, such as seller financing. But be aware these kinds of arrangements are rare and hard to find. Depending on the market, you will likely get more help from a seller if you ask them to pay closing costs or contribute to your mortgage rate buydown. In many cases, we can help you negotiate seller concessions that make your home purchase more affordable. Expand Your Home Search If you’re having trouble finding a home within your budget, consider broadening your search criteria. You may be surprised by the kinds of deals that are available when you're willing to compromise. For example, if you're struggling to find an affordable home in your target neighborhood, expand your search area and consider homes that are further out of town or that are located in up-and-coming areas with lower starting prices. We would be happy to introduce you to some great but lesser-known neighborhoods that we consider hidden gems. You could also save money on your home purchase simply by dropping or revising some of your must-haves and settling for OK-to-haves instead. For example, do you really need two bathrooms and a large backyard? Or could you settle for a single bathroom with space to add a second one in the future? And would a small garden, cozy balcony, or rooftop terrace still give you the outdoor time you crave? These types of compromises can sometimes shave tens of thousands off your purchase price. Similarly, if you don't mind rolling up your sleeves or working with a contractor on minor jobs, you can look for homes that need a little TLC. Just because a house looks dated doesn't mean it's destined to stay that way or that it will take a ton of money to spruce up. In fact, a home with good bones but cosmetic flaws could be a perfect match: With less competition, you'll have a better chance of purchasing the home at an affordable price. You can then take your time to save more and fix it up to your taste. Keep in mind, starter homes are rarely forever homes, but merely a first step onto the property ladder. By gaining a foothold in the real estate market now, you can set yourself up to afford a more expensive property in the future. According to the National Association of Realtors, in 2021, the net worth of a typical homeowner was $300,000, while that of a renter was only $8,000.9 We can help you find an affordable first home so you can start building equity to reach your long-term financial and real estate goals. YOU CAN DO IT—AND WE CAN HELP Buying a first home is challenging, but it's not impossible—especially when you have a savvy real estate professional in your corner. We will work with you to devise a plan to overcome your financial constraints. Then, we’ll help you find a home that not only excites you but also fits your budget and lifestyle. Give us a call to get started with a free exploratory consultation. *The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: Housing Wire -https://www.housingwire.com/articles/housing-affordability-ends-2022-at-record-low/ Realtor.com -https://www.realtor.com/news/trends/death-of-the-starter-home-where-have-all-the-small-houses-gone/ National Association of Realtors -https://www.nar.realtor/research-and-statistics/research-reports/highlights-from-the-profile-of-home-buyers-and-sellers ValuePenguin -https://www.valuepenguin.com/mortgages/claiming-rental-income-for-mortgage Pew -https://www.pewresearch.org/fact-tank/2022/07/20/young-adults-in-u-s-are-much-more-likely-than-50-years-ago-to-be-living-in-a-multigenerational-household/ YouGov -https://today.yougov.com/topics/economy/articles-reports/2022/05/25/american-homebuyers-finanancial-help-parents Bankrate -https://www.bankrate.com/mortgages/first-time-homebuyer-grants/#types Investopedia -https://www.investopedia.com/terms/f/fhaloan.asp National Association of Realtors -https://www.nar.realtor/sites/default/files/documents/2022-snapshot-of-race-and-home-buying-in-the-us-04-26-2022.pdf

Categories

Recent Posts