35 Tips to Furnish Your New Home for Less

Buying a new home is one of the most exciting experiences in life. And if you’re like most homebuyers, you’ll be planning your furniture placement and decor before the ink dries on your offer letter. But before you run to the nearest home goods store, take a deep breath. First, you’ll need to delay

Income Properties Are Trending, But Is Landlord Life for You?

If the thought of investing your money into brick and mortar—or perhaps some stylishly-painted siding—excites you, join the club. Investing in real estate has long been one of Americans' favorite ways to grow their wealth. In fact, over 70% of single-family rental properties are currently owned by

Top 7 Tips To Attract the Best Offers for Your Home

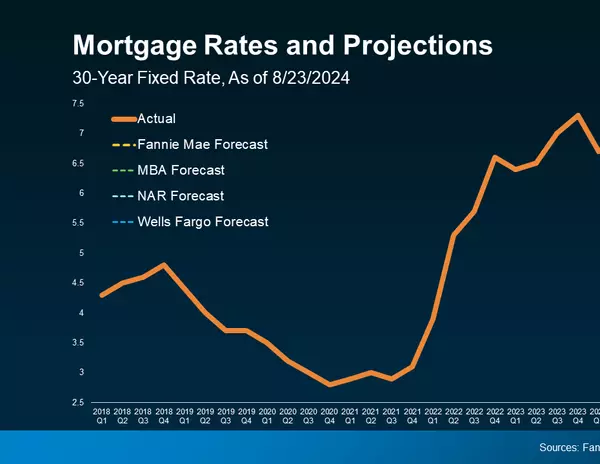

Not long ago, home sellers were in their heyday, as historically-low mortgage rates triggered a real estate buying frenzy. However, the Federal Reserve shut down the party when it began raising interest rates last year.1 Now, it’s not as simple to sell a home. While pandemic-era homebuyers were ra

Categories

Recent Posts