How to Bridge the Appraisal Gap in Today’s Real Estate Market

If you’re searching for drama, don’t limit yourself to Netflix. Instead, tune in to the real estate market, where the competition among buyers has never been fiercer. And with homes selling for record highs,1 the appraisal process—historically a standard part of a home purchase—is receiving more attention than ever. That’s because some sellers are finding out the hard way that a strong offer can fizzle quickly when an appraisal comes in below the contract price. Traditionally, the sale of a home is contingent on a satisfactory valuation. But in a rapidly appreciating market, it can be difficult for appraisals to keep pace with rising prices. Thus, many sellers in today’s market favor buyers who are willing to guarantee their full offer price—even if the property appraises for less. For the buyer, that could require a financial leap of faith that the home is a solid investment. It also means they may need to come up with additional cash at closing to cover the gap. Whether you’re a buyer or a seller, it’s never been more important to understand the appraisal process and how it can be impacted by a quickly appreciating and highly competitive housing market. It’s also crucial to work with a skilled real estate agent who can guide you to a successful closing without overpaying (if you’re a buyer) or overcompensating (if you’re a seller). Find out how appraisals work—and in some cases, don’t work—in today’s unique real estate environment. APPRAISAL REQUIREMENTS An appraisal is an objective assessment of a property’s market value performed by an independent authorized appraiser. Mortgage lenders require an appraisal to lower their risk of loss in the event a buyer defaults on their loan. It provides assurance that the home’s value meets or exceeds the amount being lent for its purchase. In most cases, a licensed appraiser will analyze the property’s condition and review the value of comparable properties that have recently sold. Mortgage borrowers are usually expected to pay the cost of an appraisal. These fees are often due upfront and non-refundable.2 Appraisal requirements can vary by lender and loan type, and in today’s market in-person appraisal waivers have become much more common. Analysis of the property, the local market, and the buyer’s qualifications will determine whether the appraisal will be waived. Not all properties or buyers will qualify, and not all mortgage lenders will utilize this system.3 If you’re applying for a mortgage, be sure to ask your lender about their specific terms. If you’re a cash buyer, you may choose—but are not obligated—to order an appraisal. APPRAISALS IN A RAPIDLY SHIFTING MARKET An appraisal contingency is a standard inclusion in a home purchase offer. It enables the buyer to make the closing of the transaction dependent on a satisfactory appraisal wherein the value of the property is at or near the purchase price. This helps to reassure the buyer (and their lender) that they are paying fair market value for the home and allows them to cancel the contract if the appraisal is lower than expected. Low appraisals are not common, but they are more likely to happen in a rapidly appreciating market, like the one we’re experiencing now.4 That’s because appraisers must use comparable sales (commonly referred to as comps) to determine a property’s value. These could include homes that went under contract weeks or even months ago. With home prices rising so quickly,5 today’s comps may be lagging behind the market’s current reality. Thus, the appraiser could be basing their assessment on stale data, resulting in a low valuation. HOW ARE BUYERS AND SELLERS IMPACTED BY A LOW APPRAISAL? When a property appraises for less than the contract price, you end up with an appraisal gap. In a more balanced market, that could be cause for a renegotiation. In today’s market, however, sellers often hold the upper hand. That’s why some buyers are using the potential for an appraisal gap as a way to strengthen their bids. They’re proposing to take on some or all of the risk of a low appraisal by adding gap coverage or a contingency waiver to their offer. Appraisal Gap Coverage Buyers with some extra cash on hand may opt to add an appraisal gap coverage clause to their offer. It provides an added level of reassurance to the sellers that, in the event of a low appraisal, the buyer is willing and able to cover the gap up to a certain amount.6 For example, let’s say a home is listed for $200,000 and the buyers offer $220,000 with $10,000 in appraisal gap coverage. Now, let’s say the property appraises for $205,000. The new purchase price would be $215,000. The buyers would be responsible for paying $10,000 of that in cash directly to the seller because, in most cases, mortgage companies won’t include appraisal gap coverage in a home loan.6 Waiving The Appraisal Contingency Some buyers with a higher risk tolerance—and the financial means—may be willing to waive the appraisal contingency altogether. However, this strategy isn’t for everyone and must be considered on a case-by-case basis. It’s important to remember that waiving an appraisal contingency can leave a buyer vulnerable if the appraisal comes back much lower than the contract price. Without an appraisal contingency, a buyer will be obligated to cover the difference or be forced to walk away from the transaction and relinquish their earnest money deposit to the sellers.7 It’s vital that both buyers and sellers understand the benefits and risks involved with these and other competitive tactics that are becoming more commonplace in today’s market. We can help you chart the best course of action given your individual circumstances. DON’T WAIVE YOUR RIGHT TO THE BEST REPRESENTATION There’s never been a market quite like this one before. That’s why you need a master negotiator on your side who has the skills, instincts, and experience to get the deal done...no matter what surprises may pop up along the way. If you’re a buyer, we can help you compete in this unprecedented market—without getting steamrolled. And if you’re a seller, we know how to get top dollar for your home while minimizing hassle and stress. Contact us today to schedule a complimentary consultation. Sources: Wall Street Journal -https://www.wsj.com/articles/u-s-home-prices-push-to-record-high-slowing-pace-of-purchases-11621605953 US News & World Report - https://realestate.usnews.com/real-estate/articles/what-is-a-home-appraisal-and-who-pays-for-it Rocket Mortgage –https://www.rocketmortgage.com/learn/appraisal-waiver Money -https://money.com/coronavirus-low-home-appraisal/ S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index - https://www.spglobal.com/spdji/en/indices/indicators/sp-corelogic-case-shiller-20-city-composite-home-price-nsa-index/#overview Bigger Pockets -https://www.biggerpockets.com/blog/appraisal-gap-coverage Washington Post -https://www.washingtonpost.com/realestate/competitive-buyers-waive-contingencies-to-score-homes-in-tight-market/2021/06/02/d335b050-af2c-11eb-b476-c3b287e52a01_story.html

Could Rising Home Prices Impact Your Net Worth?

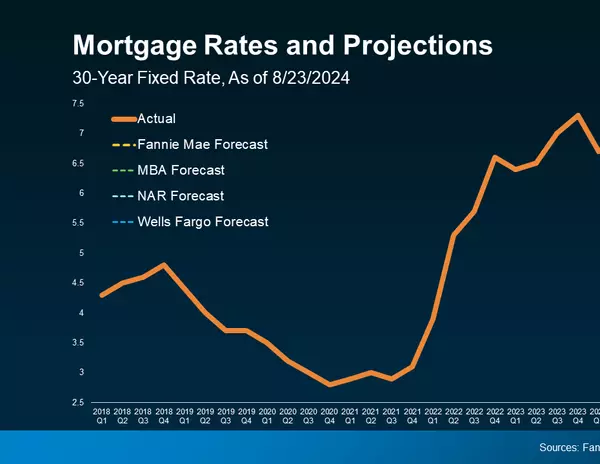

Learn how to determine your current net worth and how an investment in real estate can help improve your bottom line. Among its many impacts, COVID-19 has had a pronounced effect on the housing market. Low home inventory and high buyer demand have driven home prices to an all-time high.1 This has given an unexpected financial boost to many homeowners during a challenging time. However, for some renters, rising home prices are making dreams of homeownership feel further out of reach. If you’re a homeowner, it’s important for you to understand how your home’s value contributes to your overall net worth. If you’re a renter, now is the time for you to figure out how homeownership fits into your short-term goals and your long-term financial future. An investment in real estate can help you grow your net worth, build wealth over time, and gain a foothold in the housing market to keep pace with rising prices. What is net worth? Net worth is the net balance of your total assets minus your total liabilities. Or, basically, it is what you own minus what you owe.2 Assets include the cash you have on hand in your checking and savings accounts, investment account balances, salable items like jewelry or a car and, of course, your home and any other real estate you own. Liabilities include your total debt obligations like car loans, credit card debt, the amount you owe on your mortgage, and student loans. In addition, liabilities would include any other payment obligations you have, like outstanding bills and taxes. How do I calculate my net worth? To calculate your net worth, you’ll want to add up all of your assets and all of your liabilities. Then subtract your total liabilities from your total assets. The balance represents your current net worth. Total Assets – Total Liabilities = Net Worth Ready to calculate your net worth? Contact us to request an easy-to-use worksheet and a free assessment of your home’s current market value! Keep in mind that your net worth is a snapshot of your financial position at a single point in time. Your assets and liabilities will fluctuate over both the short term and long term. For example, if you take out a loan to buy a car, you decrease your liability with each payment. Of course, the value of your asset (the car) will depreciate over time, as well. An asset that is invested in stocks or bonds can be even less predictable, as it’s subject to daily fluctuations in the market. As a homeowner, you enjoy significant stability through your monthly real estate investment, also known as your home mortgage payment. While the actual value of your home can fluctuate depending on market conditions, your mortgage payment will decrease your liability each month. And unlike a vehicle purchase, the value of your home is likely to appreciate over time, which can help to grow your net worth. Right now, your asset may be worth significantly more than it was this time last year.3 If you’re a homeowner, contact us for an estimate of your home’s market value so that you can factor it into your net worth calculation. If you’re not a current homeowner, let’s talk about how homes in our area have appreciated over the last several years. That way, you can get an idea of how a home purchase could positively affect your net worth. How can real estate increase my net worth? When you put your real estate dollars to work, it’s possible to grow your net worth, generate cash flow, and even fund your retirement. We can help you realize the possibilities and maximize the return on your investment. Property Appreciation Generally, property appreciates in one of two ways: either through changes to the overall market or through value-added modifications to the property itself. 1. Rising prices This type of property appreciation is the one that many homeowners are enjoying right now. Buyer demand is at an all-time high due to a combination of record-low interest rates and limited housing inventory.4 At other times, rising home prices have been attributed to different factors. Certain local conditions—like a new commercial development, influx of jobs, or infrastructure project—can encourage rapid growth in a community or region and a corresponding rise in home values. Historically, home prices have been shown to experience an upward trend punctuated by intermittent booms and corrections.5 2. Strategic home improvements. Well-planned and executed home improvements can also impact a home’s value and increase homeowner equity at the same time. The type of home improvement should be appropriate for the home and in tune with the desires of local buyers For example, a tasteful exterior remodel that is in keeping with the preferences of local home buyers is likely to add significant value to a home, while remodeling the home to look like the Taj Mahal or a favorite theme park attraction will not. A modern kitchen remodel tends to add value, while a kitchen remodel that is overly expensive or personalized may not provide an adequate return on investment. Investment Property You may be used to thinking of investments primarily in terms of stocks and bonds. However, the purchase of a real estate investment property offers the opportunity to increase your net worth both upon purchase and year after year through appreciation. In addition, rental payments can have a positive impact on your monthly income and cash flow. If you currently have significant equity in your home, let's talk about how you could put that equity to work by funding the purchase of an investment property. 1. Long-term or traditional rental A long-term rental property is one that is leased for an extended period and typically used as a primary residence by the renter. This type of real estate investment offers you the opportunity to generate consistent cash flow while building equity and appreciation.6 As an owner, you don’t usually have to worry about paying the utility bills or furnishing the property—both of which are typically covered by the tenant. Add to this the fact that traditional tenants translate into less time and effort spent on day-to-day property management, and long-term rentals are an attractive option for many investors. 2. Short-term or vacation rental Short-term rentals are often referred to as vacation rentals because they are primarily geared towards recreational travelers. And as more people start to feel comfortable traveling again, the short-term rental market is poised to become a more popular option than ever. In 2020 alone, in the thick of widespread travel bans, the short-term rental platform Airbnb’s market share of the hospitality industry reached as high as 41 percent.6 Investing in a short-term rental offers many benefits. If you purchase an investment property in a top tourist destination, you can expect steady demand from travelers while taking advantage of any non-rented periods to enjoy the home yourself. You can also adjust your rental price around peak demand to maximize your cash flow while building equity and long-term appreciation. To reap these benefits, however, you’ll need to understand the local laws and regulations on short-term rentals. We can help you identify suitable markets with investment potential. WE’RE HERE TO HELP Ready to calculate your personal net worth? Contact us for an easy-to-use worksheet and to find out your home’s current value. And if you want to learn more about growing your net worth through real estate, we can schedule a free consultation to answer your questions and explore your options. Whether you’re hoping to maximize the value of your current home or invest in a new property, we’re here to help you achieve your real estate goals. The above references an opinion and is for informational purposes only. It is not intended to be financial advice. Consult the appropriate professionals for advice regarding your individual needs. Sources: National Association of Realtors -https://www.nar.realtor/newsroom/housing-market-reaches-record-high-home-price-and-gains-in-march Forbes -https://www.forbes.com/advisor/investing/what-is-net-worth/ The Washington Post -https://www.washingtonpost.com/business/on-small-business/your-net-worth-is-americas-secret-economic-weapon/2020/08/20/70df5b92-e2d4-11ea-82d8-5e55d47e90ca_story.html Bloomberg -https://www.bloomberg.com/news/articles/2021-04-09/home-prices-soar-in-frenzied-u-s-market-drained-of-supply Federal Reserve Economic Data -https://fred.stlouisfed.org/series/MSPUS Propmodo -https://www.propmodo.com/what-the-growing-short-term-rental-market-means-for-multifamily-real-estate/

Categories

Recent Posts